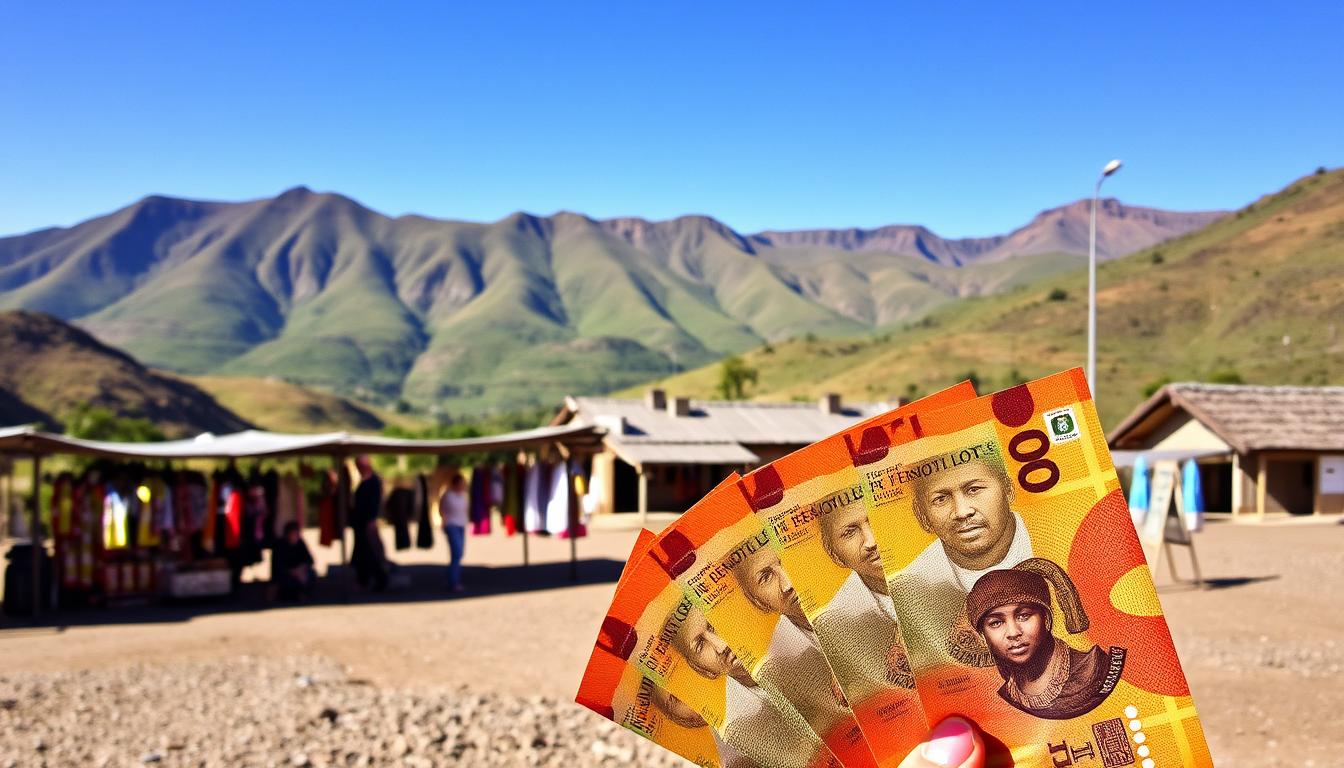

Did you know that Lesotho’s currency, the Loti, is pegged 1:1 to the South African Rand? This unique feature makes it easier for visitors to manage their money while exploring this stunning mountain kingdom.

Whether you’re planning a short trip or an extended stay, understanding the local currency landscape is essential. This guide will help you navigate exchange rates, fees, and payment options to make your journey smoother.

From using cash for small purchases to leveraging travel cards for convenience, we’ll cover everything you need to know. Our goal is to help you save money and avoid common pitfalls, so you can focus on enjoying your travel experience.

Ready to dive in? Let’s explore the best ways to handle your finances in this breathtaking destination.

Understanding Lesotho’s Currency Landscape

Handling money in Lesotho starts with knowing the basics of the Loti and exchange rates. The Lesotho Loti is the official currency, and it’s pegged 1:1 to the South African Rand. This makes it easier for you to manage your finances while exploring the country.

Lesotho Loti Explained

The Lesotho Loti (LSL) is the backbone of the country’s financial system. It’s widely accepted for all transactions, from small purchases to larger expenses. Since it’s tied to the Rand, you’ll often find both currencies used interchangeably.

Exchange Rate Basics and Mid-Market Rates

Exchange rates determine how much your money is worth in another currency. The mid-market rate is the fairest rate, used by banks and financial institutions. It’s the rate you’ll see on financial news or currency converter apps.

“The mid-market rate is the most transparent and fair rate for currency exchange.”

Here’s a quick comparison of where you can exchange your money:

| Provider | Exchange Rate | Fees |

|---|---|---|

| Banks | Mid-market rate | Low to moderate |

| Local Exchange Providers | Varies | Higher |

Tracking the mid-market rate ensures you get the best deal. Rate fluctuations can impact your spending, so it’s wise to monitor them before exchanging large amounts. For example, a small change in the rate can save or cost you significantly during your trip.

Planning Your Currency Exchange Strategy

Planning your currency exchange strategy can save you time and money during your travel. A solid plan ensures you get the best rates and avoid unnecessary fees. Whether you’re exchanging at home or upon arrival, knowing your options is key.

Comparing Local and Online Exchange Options

Local exchange providers and online platforms both have their pros and cons. Local providers are convenient, but their rates can vary. Online platforms often offer better rates and lower fees, making them a popular choice for savvy travelers.

Here’s a quick comparison to help you decide:

| Provider | Pros | Cons |

|---|---|---|

| Local Exchange | Immediate access | Higher fees |

| Online Platforms | Better rates | Requires planning |

Using online tools to monitor live exchange rates can also give you an edge. Platforms like Wise and Revolut provide real-time updates, helping you exchange at the best time.

When and Where to Exchange Currency

Deciding whether to exchange at home or upon arrival depends on your travel plans. Exchanging in advance ensures you have cash ready, but rates at airports are often less favorable. Local banks and ATMs can be a better option once you arrive.

Here are some tips to make the process smoother:

- Compare rates from multiple providers.

- Use a travel card for convenience and security.

- Plan ahead to avoid last-minute markups.

By taking these steps, you can manage your money more effectively and focus on enjoying your trip.

Why Exchange USD to LSL in Advance

Exchanging your USD to LSL before your trip can save you both time and money. Preparing your currency in advance ensures you’re ready to go as soon as you arrive. It’s the best way to avoid last-minute hassles and high fees.

Benefits of Exchanging Before Your Trip

Converting your money early often means better rates and lower fees. Local banks and online platforms usually offer more favorable conditions than airport kiosks. This can save you a significant amount, especially if you’re exchanging large sums.

For example, exchanging $500 in advance could save you up to $30 compared to doing it at the airport. Plus, you’ll have cash ready for immediate expenses like transportation or meals.

Avoiding Airport Currency Markups

Airport exchanges are convenient but often come with high markups. These providers know you’re in a captive market, so they charge premium rates. By exchanging in advance, you bypass these unnecessary costs.

Here’s a quick comparison of exchange rates and fees:

| Provider | Exchange Rate | Fees |

|---|---|---|

| Local Bank | Mid-market rate | Low |

| Airport Kiosk | Marked up | High |

Using online tools like Wise or Revolut can also help you monitor live rates and exchange at the right time. This proactive approach ensures you get the most value for your money.

By planning ahead, you’ll reduce stress and focus on enjoying your trip. Exchanging in advance is a simple step that makes a big difference.

Lesotho: Ultimate Travelers Guide to Currencies & Payments

Navigating your finances in a new destination can be simple with the right preparation. This guide is designed to help you manage your money effectively, whether you’re a first-time visitor or a seasoned traveler. From understanding exchange rates to choosing the best payment methods, we’ve got you covered.

One of the key takeaways is the importance of planning ahead. By exchanging your currency in advance, you can avoid high fees and markups. This ensures you’re ready to explore without worrying about last-minute financial hiccups.

Having multiple payment options is another essential tip. While cash is widely accepted, carrying a travel card or using mobile payment apps can add convenience and security. This flexibility allows you to adapt to any situation during your trip.

Here’s a quick summary of the benefits of being informed:

| Benefit | Why It Matters |

|---|---|

| Better Exchange Rates | Saves you money and maximizes your spending power. |

| Multiple Payment Options | Ensures you’re prepared for any situation. |

| Reduced Stress | Allows you to focus on enjoying your trip. |

By following these tips, you can enjoy a smoother and more cost-effective journey. Being informed about your finances ensures you’re ready to make the most of your travel experience.

Payment Methods in Lesotho: Card and Cash Options

When visiting Lesotho, understanding your payment options can make your trip smoother and more enjoyable. Whether you prefer the convenience of a card or the flexibility of cash, knowing how to use both effectively will save you time and money.

Using Your Travel Debit Card Effectively

A travel debit card is one of the most secure and cost-effective ways to manage your expenses. These cards often offer low conversion fees and real-time transaction tracking, making them ideal for budgeting. For example, platforms like Wise provide competitive rates and easy account management.

Using your debit card at ATMs is also convenient, especially in urban areas. However, always check for transaction limits and fees to avoid surprises. Regular monitoring of your account ensures you stay within your budget.

Carrying Cash in LSL for Small Purchases

While cards are widely accepted, carrying cash in the local currency (LSL) is essential for small purchases, tipping, and rural areas. Many local vendors and markets prefer cash, so having some on hand ensures you’re prepared for any situation.

Here are some practical tips for managing your cash:

- Withdraw larger amounts to minimize ATM fees.

- Keep small denominations for convenience.

- Store your cash securely to avoid loss or theft.

By combining the convenience of a card with the flexibility of cash, you can navigate Lesotho’s payment landscape with ease. This approach ensures you’re ready for any scenario, from dining at a restaurant to shopping at a local market.

Security Tips for Currency and Card Payments

Keeping your finances secure while traveling is as important as planning your itinerary. Protecting your bank card and cash ensures a smooth and stress-free experience. Here are actionable tips to safeguard your funds and payment methods.

First, consider using a card not linked to your main bank account. This reduces risk in case of theft or fraud. Enable two-factor authentication for added security, and use card freezing options if your card is lost or stolen.

Always keep emergency contact details for your card provider handy. This allows you to act quickly in case of issues. Additionally, split your money across different wallets or storage solutions to minimize loss in case of theft.

Be cautious of dynamic currency conversion (DCC) when paying with your card. This service often charges higher fees and offers unfavorable exchange rates. Always opt to pay in the local currency to avoid unnecessary costs.

“Dynamic currency conversion may seem convenient, but it often comes with hidden fees.”

When using ATMs, choose machines located in secure areas like banks. Shield your PIN and avoid crowded places when handling your bank card. These simple steps can prevent unauthorized access to your funds.

By following these tips, you can protect your card and cash, ensuring a safer and more enjoyable travel experience. Staying vigilant and prepared is the key to financial security abroad.

Using Travel Money Cards: Wise, Revolut, and More

Travel money cards are a game-changer for managing your finances abroad. They offer secure, low-cost, and user-friendly solutions for international spending. Whether you’re exploring new destinations or returning to a favorite spot, these cards simplify your financial planning.

Choosing the Best Travel Card for Your Needs

Popular options like Wise and Revolut stand out for their mid-market exchange rates and low fees. These cards allow you to load multiple currencies, making them ideal for frequent travelers. For example, Wise supports spending in 48 currencies, while Revolut offers transfers to over 200 countries.

When selecting a travel card, consider factors like fees, exchange rates, and usability. Here’s a quick comparison:

- Wise: No markup on exchange rates, with a transfer fee starting at 0.33%.

- Revolut: Adds a small markup of 0.25% for currency conversions, with a 1% fee on weekends.

Both cards are compatible with mobile wallets like Apple Pay and Google Pay, adding to their convenience.

Managing Your Account with Mobile Apps

Mobile apps make it easy to manage your travel money on the go. With real-time spending tracking and instant notifications, you can stay on top of your budget. For instance, Wise’s app allows you to monitor live exchange rates, while Revolut’s app offers card freezing options for added security.

These apps also provide features like ATM withdrawal limits and fee breakdowns. For example, Wise charges 1.75% plus £0.50 after two withdrawals, while Revolut applies a 1% markup after exceeding £1,000 in conversions.

“Mobile apps transform how you manage your finances, offering control and transparency at your fingertips.”

By choosing the right card provider like Wise or Revolut, you can enjoy seamless financial management during your travels. These tools ensure you’re prepared for any situation, from dining out to shopping abroad.

Debit, Prepaid, and Credit Card Comparisons

Choosing the right card for your travels can make a big difference in managing your expenses. Whether you prefer a debit card, credit card, or travel card, each option has its own benefits and drawbacks. Understanding these can help you save money and avoid unnecessary fees.

Pros and Cons of Each Card Type

Debit cards are a popular choice for travelers because they allow you to spend only what you have. They often have lower transaction fees compared to credit cards. However, they may not offer the same level of fraud protection or rewards programs.

Credit cards, on the other hand, provide greater flexibility and perks like travel insurance or cashback. But they can come with higher fees, especially for foreign transactions. Some cards charge up to 3% for international purchases, which can add up quickly.

Travel cards, like those from Wise or Revolut, are designed for international use. They offer competitive exchange rates and low fees. However, they may have limits on ATM withdrawals or require advance loading of funds.

“A travel card can save you up to 88% on currency conversion fees compared to traditional bank services.”

Here’s a quick comparison to help you decide:

- Debit Card: Low fees, but limited protection and rewards.

- Credit Card: Great perks, but higher fees for international use.

- Travel Card: Best for low fees and competitive rates, but may have usage limits.

When selecting a card, consider your spending habits and travel needs. For example, if you plan to make large purchases, a credit card with rewards might be ideal. For everyday expenses, a debit card or travel card could save you money on fees.

By understanding the pros and cons of each card type, you can make informed decisions and maximize your travel budget. Always check for hidden fees and compare options before your trip.

Avoiding Extra Fees: Foreign Transaction and ATM Charges

Managing your finances abroad doesn’t have to come with hidden surprises. Extra fees like foreign transaction and ATM charges can quickly add up if you’re not careful. Understanding how these fees work can save you money and make your trip smoother.

Understanding Fee Structures and Hidden Costs

When using your card overseas, banks often charge a foreign transaction fee, typically 1-3% of the purchase amount. This fee applies every time you make a payment in a different currency. Similarly, withdrawing cash from an ATM can come with additional costs, including withdrawal fees and currency conversion markups.

Here’s a breakdown of common fees you might encounter:

- Foreign Transaction Fee: Charged for purchases in a foreign currency.

- ATM Withdrawal Fee: Applied when using an ATM abroad.

- Currency Conversion Fee: Added when your bank converts the transaction amount.

Travel money cards like Wise and Revolut can help you avoid these extra costs. They offer competitive exchange rates and low fees, making them a smart choice for international travelers.

Tips to Minimize Unnecessary Charges

To reduce fees, consider these strategies:

- Use a travel card with low international fees.

- Withdraw larger amounts to minimize ATM fees.

- Always opt to pay in the local currency to avoid dynamic currency conversion charges.

“Using a travel card can save you up to 88% on currency conversion fees compared to traditional bank services.”

Here’s a comparison of fees across different providers:

| Provider | Foreign Transaction Fee | ATM Withdrawal Fee |

|---|---|---|

| Traditional Bank | 1-3% | $5 per withdrawal |

| Wise | 0% | Low fee after free limit |

| Revolut | 0% | Low fee after free limit |

By planning ahead and choosing the right tools, you can avoid unnecessary costs and focus on enjoying your trip. Always read the fine print on transaction fees to stay informed.

Exchange Rate Strategies and Tools

Staying ahead of exchange rate changes can save you money during your travels. Monitoring live rates helps you make smarter financial decisions and ensures you’re always getting the best value for your currency.

Monitoring Live Rates for Better Deals

Real-time tracking of exchange rates allows you to convert your money at the most favorable times. Tools like Wise and Revolut provide live updates, helping you stay informed about rate fluctuations. This can lead to significant savings, especially when exchanging large amounts.

Here are some popular tools to consider:

- Wise: Offers mid-market rates with low fees and real-time tracking.

- Revolut: Provides live rate alerts and multi-currency support.

- XE Currency: A reliable app for checking live exchange rates.

Setting alerts for favorable rates ensures you don’t miss out on the best deals. For example, if the rate drops to a level you’re comfortable with, you’ll receive a notification to act quickly.

“Monitoring live exchange rates can save you up to 10% on currency conversions compared to last-minute exchanges.”

Understanding rate trends is also crucial. By analyzing historical data, you can predict when the exchange rate might improve. This proactive approach helps you manage your travel budget more effectively.

Regularly checking live data ensures you’re always making informed decisions. Whether you’re converting money for daily expenses or planning a large purchase, staying updated on exchange rates is a smart move.

How to Withdraw Cash Safely in Lesotho

Withdrawing cash safely in a new country requires awareness and preparation. Knowing where and how to use ATMs can save you from unnecessary risks and fees. Here’s how to manage your cash securely while exploring.

Start by locating secure ATMs. Choose machines inside banks, shopping centers, or tourist areas. These locations are often monitored and less likely to have skimming devices. Avoid isolated or poorly lit areas, especially after dark.

When using an ATM, always check for suspicious attachments or cameras. Cover the keypad while entering your PIN to prevent theft. If something feels off, cancel the transaction and find another machine.

Ensure the ATM dispenses the local currency (LSL). Some machines may offer dynamic currency conversion, which often comes with higher fees. Always opt for the local currency to avoid unnecessary charges.

“Using a travel debit card with fee transparency can save you money and reduce risks during ATM withdrawals.”

Here are additional tips to stay safe:

- Withdraw only the amount you need to minimize risk.

- Use a travel debit card with low fees and real-time transaction tracking.

- Keep emergency contact details for your bank or card provider handy.

By following these steps, you can ensure a smooth and secure experience when accessing cash abroad. Staying vigilant and prepared is the key to financial safety during your travels.

Navigating Payments in Hospitality and Retail

Making payments in hospitality and retail settings can be straightforward with the right approach. Whether you’re staying at a hotel, dining at a restaurant, or shopping locally, knowing how to handle your payments ensures a smooth experience.

Using Your Card Effectively

Using a card is convenient and secure, especially in tourist spots. Most hotels and larger restaurants accept major credit and debit cards. Always check if your card provider charges foreign transaction fees to avoid surprises.

When paying with a card, opt for the local currency to avoid dynamic currency conversion charges. This service often adds unnecessary fees and unfavorable exchange rates. For example, paying in LSL instead of USD can save you up to 3% on each transaction.

Carrying Cash for Flexibility

While cards are widely accepted, carrying cash is essential for smaller purchases and local markets. Many vendors prefer cash, especially in rural areas. Having small denominations makes it easier to pay for items like souvenirs or street food.

Here are some tips for managing your cash:

- Withdraw larger amounts to minimize ATM fees.

- Keep your cash secure in a money belt or hidden pouch.

- Use cash for tipping and small transactions.

Negotiating Prices in Retail Settings

In some retail settings, especially local markets, cash may be preferred, and prices can be negotiable. Polite bargaining is common and can lead to better deals. For example, offering to pay in cash might encourage vendors to lower their prices.

Always maintain a balance between cash and card usage. This flexibility ensures you’re prepared for any situation, whether you’re dining at a fancy restaurant or shopping at a street market.

| Payment Method | Best For | Tips |

|---|---|---|

| Card | Hotels, restaurants, larger shops | Opt for local currency to avoid fees |

| Cash | Markets, small vendors, tipping | Carry small denominations for convenience |

By following these tips, you can navigate payments in hospitality and retail settings with ease. Whether you prefer the convenience of a card or the flexibility of cash, being prepared ensures a stress-free experience.

Planning Your Travel Budget in Lesotho

Planning your travel budget wisely ensures a stress-free and enjoyable experience. Knowing your daily expenses helps you manage your money effectively and avoid overspending. Whether you’re on a tight budget or looking for a more luxurious trip, understanding the cost of essentials is key.

Average Costs for Accommodation and Transport

Accommodation and transport are two of the biggest expenses during your trip. Budget options like hostels or guesthouses start at around $10 per night, while mid-range hotels average $22. For a more luxurious stay, expect to pay $43 or more.

Transport costs vary depending on your mode of travel. Local buses are the most affordable, while renting a car can add to your price. Taxis are convenient but tend to be pricier, especially for longer distances.

Budgeting for Meals and Entertainment

Food and entertainment are essential parts of your travel experience. Budget meals cost around $12 per day, while mid-range dining averages $28. If you’re splurging, luxury meals can set you back $54 daily.

Entertainment costs, such as visiting attractions or enjoying local activities, average $15 per day. Planning for these expenses ensures you can enjoy your trip without financial stress.

Here’s a breakdown of daily costs to help you plan:

| Category | Budget | Mid-Range | Luxury |

|---|---|---|---|

| Accommodation | $10 | $22 | $43 |

| Meals | $12 | $28 | $54 |

| Transport | $5 | $10 | $20 |

| Entertainment | $5 | $10 | $20 |

To stay within your budget, consider these tips:

- Track your spending daily to avoid overspending.

- Set aside a contingency fund for emergencies.

- Use a travel card to manage your money securely.

By planning ahead and monitoring your expenses, you can enjoy a memorable trip without breaking the bank. A well-prepared budget ensures you’re ready for both essentials and occasional extras like souvenirs or tours.

Money-Saving Tips for Currency Exchange

Saving money on currency exchange starts with knowing the best strategies and tools. By planning ahead and understanding the exchange rate, you can avoid unnecessary fees and get the most value for your money.

One of the best ways to save is by exchanging your currency before your trip. Local banks and online platforms often offer better rates than airport kiosks. For example, exchanging $500 in advance could save you up to $30 compared to doing it at the airport.

Using online tools like Wise or Revolut can also help you monitor live exchange rates. These platforms provide real-time updates, allowing you to convert your money at the most favorable times. This proactive approach ensures you get the most value for your currency.

Here are some actionable tips to save money:

- Compare rates from multiple providers to find the low cost option.

- Use a travel card for convenience and to avoid high fee apply.

- Always opt to pay in the local currency to avoid dynamic currency conversion charges.

“Monitoring live exchange rates can save you up to 10% on currency conversions compared to last-minute exchanges.”

Another strategy is to withdraw larger amounts of cash to minimize ATM fees. This reduces the number of transactions and keeps your costs down. Always check for fixed costs per transaction to potentially save on fees.

Here’s a quick comparison of typical costs:

| Provider | Exchange Rate | Fees |

|---|---|---|

| Local Bank | Mid-market rate | Low |

| Airport Kiosk | Marked up | High |

By adopting these strategies, you can save money and focus on enjoying your trip. Planning ahead and using the right tools ensures you get the most out of every transaction.

Managing Your Travel Money Abroad

Managing your finances while traveling requires a smart mix of payment methods and backup plans. By diversifying your options, you can avoid unnecessary fees and ensure you’re prepared for any situation. Whether you’re exploring a bustling city or a remote village, having the right tools makes all the difference.

Combining Payment Methods for Flexibility

Using a mix of travel money cards and cash ensures you’re ready for any scenario. Travel debit cards like Wise or Revolut offer low fees and real-time tracking, making them ideal for daily expenses. However, carrying cash is essential for small purchases, tipping, and areas where cards aren’t accepted.

Here’s how to balance both effectively:

- Use your card for larger purchases and online bookings.

- Carry cash for local markets, transportation, and emergencies.

- Monitor your spending through mobile apps to stay within budget.

This approach minimizes risks and ensures you’re never caught off guard.

Preparing for Emergencies and Backup Options

Unexpected situations can arise while traveling, so having a backup plan is crucial. Start by carrying a secondary card not linked to your main bank account. This reduces the risk of losing access to your funds if your primary card is lost or stolen.

Here are additional tips to stay prepared:

- Keep emergency contact details for your card provider handy.

- Store a small amount of cash in a separate location for emergencies.

- Use online banking to monitor transactions and detect any unauthorized activity.

By taking these steps, you can handle any financial hiccup with confidence.

| Payment Method | Best For | Tips |

|---|---|---|

| Travel Debit Card | Daily expenses, online bookings | Choose a card with low fees and real-time tracking |

| Cash | Local markets, tipping, emergencies | Carry small denominations and store securely |

| Backup Card | Emergencies, primary card failure | Use a card not linked to your main account |

By combining these methods, you can manage your travel money efficiently and focus on enjoying your trip. Preparedness is the key to a stress-free experience.

Conclusion

Handling your finances abroad doesn’t have to be stressful with the right tools and strategies. This guide has covered everything you need to manage your money effectively, from understanding currency exchange to choosing the best payment methods. Planning ahead ensures you secure the best rates and avoid unnecessary fees, making your trip smoother.

Using a mix of secure travel cards and cash offers flexibility and convenience. Cards like Wise and Revolut provide low fees and real-time tracking, while cash is essential for smaller purchases and local markets. Remember to follow security tips, such as monitoring transactions and storing money safely.

By applying these strategies, you can focus on enjoying your travel experience without financial worries. Share this guide with fellow adventurers and stay informed for your next trip. Safe travels!

The above is subject to change.

Check back often to TRAVEL.COM for the latest travel tips and deals.

Here are some Tours & Sightseeing suggestions that might pique your interests!