Did you know the West African CFA Franc, Mali’s official currency, is used by over 150 million people across eight countries? This makes it one of the most widely used currencies in the region. If you’re planning a trip to this vibrant West African nation, understanding how to manage your money is essential.

This guide is designed to help you navigate local money, exchange rates, and payment methods with ease. Whether you’re using a card or cash, we’ll share tips to avoid unnecessary fees and ensure secure transactions. From ATMs to local markets, we’ve got you covered.

With detailed insights and an easy-to-follow format, this guide will enhance your trip planning experience. Let’s make your journey smooth and stress-free!

Introduction to Mali’s Currency and Payment Landscape

When traveling, knowing how to handle money can make or break your experience. In Mali, the official currency is the West African CFA Franc (XOF). This is widely used across the region, making it essential to familiarize yourself with it before your trip.

Both cash and cards are important for managing your expenses. While cards are convenient for larger transactions, cash is often preferred in local markets, small shops, and rural areas. Having a mix of both ensures you’re prepared for any situation.

Practicality is key when using money in Mali. For small purchases like street food or transportation, cash is the way to go. Larger expenses, such as hotel stays, may accept cards, but it’s always good to confirm beforehand.

Managing your money wisely can enhance your travel experience. From budgeting for daily expenses to understanding exchange rates, being prepared will save you time and stress. In the following sections, we’ll dive deeper into these topics to help you plan your journey with confidence.

Understanding the West African CFA Franc

The West African CFA Franc (XOF) is a cornerstone of daily life in Mali and seven other West African nations. Pegged to the Euro at a fixed rate of 1 Euro to 655.957 XOF, this currency ensures stability across the region. Whether you’re shopping at a bustling market or paying for a meal, the XOF is your go-to for transactions.

Currency Basics and Significance

The XOF is the official currency of eight countries, including Mali. It was introduced in 1945 and has since become a symbol of economic unity in West Africa. Denominations range from coins for small purchases to larger bills for significant expenses.

This currency’s stability makes it a reliable option for both locals and travelers. Its fixed exchange rate with the Euro minimizes fluctuations, helping you manage your costs effectively. Whether you’re budgeting for a trip or planning daily expenses, the XOF simplifies financial planning.

How the CFA Franc Shapes Daily Transactions

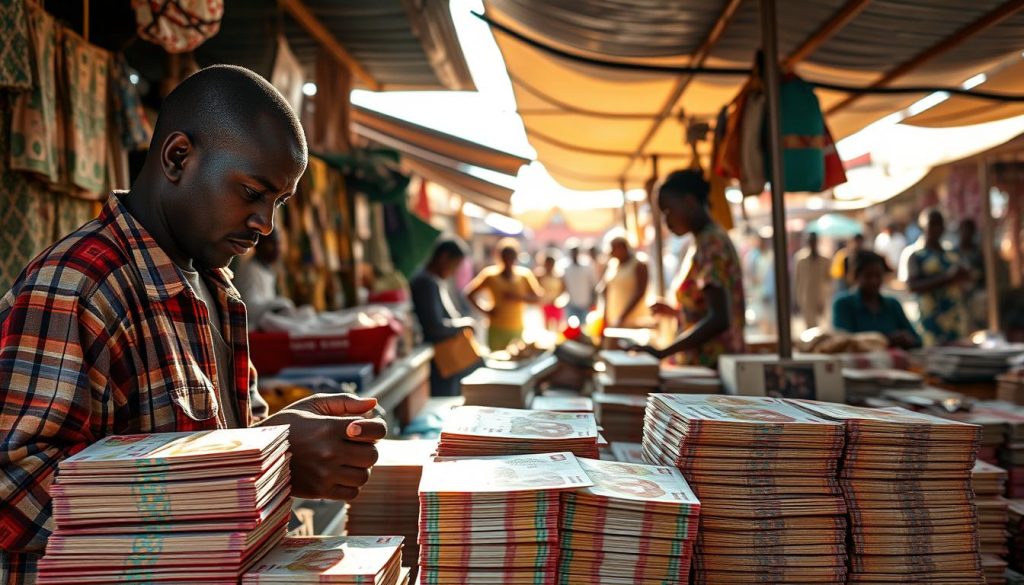

In Mali, the XOF is deeply integrated into everyday life. From market vendors to taxi drivers, cash is the preferred method for small transactions. Carrying smaller denominations ensures you’re prepared for tipping or quick purchases.

For larger expenses, cards are becoming more widely accepted, especially in urban areas. However, it’s wise to confirm payment methods beforehand to avoid surprises. This guide will help you navigate these choices with confidence.

By understanding the XOF’s role, you can make informed decisions about your account and spending. Whether you choose cash or card, being prepared ensures a smooth and enjoyable experience in Mali.

Exchange Rates: Mid-Market vs. Markup

Understanding exchange rates can save you money and make your trip smoother. Whether you’re converting cash or using a card, knowing the difference between mid-market and marked-up rates is essential. This knowledge ensures you get the best value for your money.

What is the Mid-Market Rate?

The mid-market rate is the midpoint between the buying and selling prices of two currencies on the open market. It’s the fairest way to determine the value of your money. Banks and financial institutions often update this rate once a day, making it a reliable benchmark.

For example, if the mid-market rate is 1 USD = 0.90 EUR, sending 100 USD would result in receiving 90 EUR. This rate directly impacts how much you get when converting currencies. Using it as a reference helps you avoid overpaying during exchanges.

Avoiding Extra Fees at Currency Exchanges

Many currency providers add markups to the mid-market rate, increasing your costs. These markups can range from 0.1% to 10%, significantly reducing the amount you receive. To avoid these fees, always compare rates before making an exchange.

Using a currency conversion app is a smart way to monitor live rates. Apps like Wise or XE provide real-time updates, helping you find the best time to convert your money. This precision ensures you get the most out of every transaction.

Here are some practical tips to save money:

- Check online conversion sites for the latest rates.

- Avoid airport or hotel exchanges, as they often have higher markups.

- Withdraw local currency from ATMs for better rates.

By trackingexchangerates and avoiding unnecessary fees, you can manage your travel budget more effectively.

Best Practices for Currency Exchange in Mali

Smart currency exchange practices ensure you get the most value for your budget. Whether you’re a seasoned tourist or planning your first trip mali, knowing when and where to exchange money can save you time and money.

When to Exchange Money

Timing is crucial when exchanging currency. It’s often best to convert some money before your trip mali. This way, you’ll have local cash on hand for immediate expenses like transportation or meals.

Once you arrive, monitor exchange rates using apps like XE or Wise. These tools provide real-time updates, helping you find the best time to convert more money. Avoid last-minute exchanges at airports or hotels, as they typically charge higher fees.

Where to Exchange Money

City centers and reputable exchange providers offer better rates than airports or hotels. In Mali, look for authorized currency exchange offices or banks in urban areas. These locations are more likely to provide fair rates and lower fees.

Here’s a quick comparison of exchange options:

| Location | Exchange Rate | Fees |

|---|---|---|

| City Center | Fair | Low |

| Airport | Marked Up | High |

| Hotel | Marked Up | High |

Using Travel Cards and Cash

For added flexibility, consider using an official travel card alongside cash. These cards allow you to load multiple currencies and withdraw local money at ATMs. They’re a secure backup if you run out of cash.

Many tourists find this combination works best for managing their budget. For example, use cash for small purchases and cards for larger expenses like hotels or tours.

By following these tips, you’ll make the most of your trip mali while keeping your budget intact. Plan ahead, compare rates, and choose the right mix of payment methods for a stress-free experience.

Payment Methods: Cash, Cards, and Mobile Options

Choosing the right payment method can make your travels smoother and more enjoyable. In Mali, you’ll find a mix of traditional and modern options, each with its own strengths. Whether you prefer cash, cards, or mobile payments, understanding the benefits of each will help you make the best choice for your needs.

Benefits of Using Cash and Card Payments

Cash is still king in many parts of Mali, especially in local markets and rural areas. It’s quick, widely accepted, and avoids the need for technology. Carrying smaller denominations is a smart thing to do for tipping or small purchases.

Cards, on the other hand, are convenient for larger transactions in urban areas. Many hotels, restaurants, and shops accept chip-and-pin or contactless payments. Using a card can also reduce the need to carry large amounts of cash, adding an extra layer of security.

Mobile Payments: The Future of Spending

Mobile payment options are gaining popularity, especially among younger generations. Using your phone for transactions is fast and secure. Many apps offer features like transaction tracking and fraud protection, making them a reliable case for tech-savvy travelers.

Here’s a quick comparison of the three main payment methods:

| Method | Best For | Security |

|---|---|---|

| Cash | Markets, small vendors | No tech required |

| Cards | Urban areas, larger expenses | Chip-and-pin, contactless |

| Mobile | Tech-savvy users | App-based security |

“The right payment method depends on where you are and what you’re buying. A mix of cash and cards often works best.”

Ultimately, the best thing you can do is plan ahead. Carry a mix of cash and cards, and consider using your phone for added convenience. This way, you’ll be prepared for any situation, whether you’re in a bustling city or a quiet village.

Travel Money Cards for Seamless Spending

Travel money cards are a game-changer for managing expenses abroad. They offer convenience, security, and often better exchange rates than traditional methods. Whether you’re planning a short trip or a long journey, these cards can simplify your financial plan and save you money.

These cards allow you to load multiple currencies, making it easy to switch between them as needed. They’re especially useful in regions like West Africa, where the west african cfa is the primary currency. By using a travel money card, you can avoid the hassle of carrying large amounts of cash and reduce the risk of theft.

Top International Travel Card Providers

Several providers offer excellent travel money cards, each with unique features. Here’s a comparison of the leading options:

- Wise: Known for its mid-market exchange rates and low fees, the Wise Multi-Currency Card supports over 40 currencies, including the african cfa franc. It’s a great idea for frequent travelers.

- Revolut: Offers competitive exchange rates and fee-free spending in multiple currencies. It’s ideal for tech-savvy users who prefer app-based management.

- Chime: A no-fee card that’s perfect for budget-conscious travelers. It provides real-time transaction alerts and easy account management.

- Monzo: Features fee-free spending abroad and instant spending notifications. It’s a popular choice for UK travelers.

- Netspend: Offers prepaid cards with flexible reload options. It’s a good plan for those who want to control their spending.

How to Choose the Best Card for Your Trip

Selecting the right travel money card depends on your needs and preferences. Here are some criteria to consider:

- Exchange Rates: Look for cards that offer mid-market rates to get the best value for your money.

- Fees: Compare fees for transactions, withdrawals, and currency conversions. Some cards offer fee-free options.

- Convenience: Choose a card that’s easy to load and manage, especially if you’re traveling to multiple countries.

- Security: Opt for cards with features like fraud protection and instant transaction alerts.

For example, the Wise Multi-Currency Card is a smart idea for those who frequently travel to regions using the west african cfa. It provides low fees and real-time exchange rate updates, making it a reliable choice.

By developing a personalized plan, you can choose the best card for your trip. Consider your destination, spending habits, and budget to make an informed decision. With the right travel money card, you can enjoy a stress-free and cost-effective journey.

Evaluating Debit and Credit Card Options Abroad

When traveling abroad, your choice of payment methods can significantly impact your experience. Debit and credit cards are both popular options, but each comes with its own set of advantages and limitations. Understanding these can help you make informed decisions and save money.

Pros and Cons of Using Bank Cards

Debit cards are a great choice for travelers who want low fees and easy access to cash. Many modern travel cards, like Monzo, offer fee-free ATM withdrawals and competitive exchange rates. This makes them ideal for daily expenses and emergencies.

Credit cards, on the other hand, are convenient for larger purchases and offer added security. However, they often come with foreign transaction fees, which can range from 1-3% of the purchase amount. Some cards also charge high interest rates on cash withdrawals.

“Using a mix of debit and credit cards ensures you’re prepared for any situation while keeping costs low.”

Here’s a quick comparison of the two options:

- Debit Cards: Low fees for ATM withdrawals, ideal for daily spending, but limited fraud protection.

- Credit Cards: Great for large purchases, offer fraud protection, but come with foreign transaction fees.

For example, Monzo’s debit card is a popular choice for its fee-free withdrawals and real-time spending notifications. Traditional bank cards, while reliable, may charge higher fees for international use.

When planning your trip, consider your spending habits and destination. If you’ll be using ATMs frequently, a debit card with low fees is a smart choice. For added security and convenience, a credit card can be a valuable backup.

Managing Transaction Fees and Budgeting Your Spend

Keeping your travel budget intact starts with smart financial strategies. Transaction fees and unexpected costs can add up quickly, but with the right approach, you can minimize these expenses and make the most of your money.

Strategies to Keep Costs Low

One of the easiest ways to save is by avoiding high-fee locations like airports and hotels. These places often charge marked-up rates for currency exchange and ATM withdrawals. Instead, use local banks or authorized exchange offices in city centers for better rates.

Travel cards like the Wise Multi-Currency Card are a great option. They offer mid-market exchange rates and low fees, making them ideal for international use. By loading your card with the local currency in advance, you can avoid unnecessary charges during your trip.

Here are some practical tips to reduce costs:

- Plan your budget: Estimate daily expenses and allocate funds accordingly to avoid overspending.

- Track your spending: Use apps to monitor transactions and anticipate fees.

- Mix payment methods: Use cash for small purchases and cards for larger expenses to minimize fees.

Small savings from reduced fees can add up significantly over time. For example, avoiding a 3% foreign transaction fee on a $1,000 spend saves you $30. These savings can be redirected toward experiences or souvenirs.

When using ATMs, choose ones affiliated with major banks to avoid extra charges. Also, withdraw larger amounts less frequently to reduce the number of withdrawal fees. This approach ensures you have enough cash while keeping costs low.

By combining these strategies, you can manage your budget efficiently and enjoy a stress-free trip. Planning ahead and staying informed are key to making the most of your travel funds.

Security Tips for Handling Money on Your Travels

Protecting your money while traveling is as important as planning your itinerary. Financial safety ensures a stress-free experience, allowing you to focus on enjoying your trip. Here are some practical tips to keep your funds secure.

Staying Safe with Your Cards and Cash

When using a debit card, always keep it in a secure place. Avoid carrying large amounts of cash, and split your money between different locations. This reduces the risk of losing everything at once.

Choose ATMs in well-lit, public areas or inside banks. These locations are less likely to be tampered with. Always cover the keypad when entering your PIN to prevent theft.

Enable transaction alerts on your phone. Many banks offer this feature, notifying you of every purchase or withdrawal. This helps you spot unauthorized activity immediately.

If your card or cash is compromised, act quickly. Contact your bank to block the card and report the incident to local authorities. Keep a copy of your card details in a safe place for emergencies.

“Low-cost security measures, like splitting your cash and using secure ATMs, can prevent costly financial losses.”

Here are some additional tips to safeguard your money:

- Use a money belt or hidden pouch for extra security.

- Avoid displaying large sums of cash in public.

- Keep a backup card in a separate location.

By following these steps, you can enjoy your travels with confidence. Financial safety doesn’t have to be complicated or expensive. Simple, low cost measures can make a big difference.

Using ATMs and Local Banking Services in Mali

Accessing cash and managing transactions smoothly is essential for a hassle-free trip. ATMs are widely available in urban areas, but knowing how to use them safely and efficiently can save you time and money. Here’s a guide to help you navigate local banking services with confidence.

Tips for Safe ATM Withdrawals

When using ATMs, always prioritize safety. Choose machines located in well-lit, secure areas like banks or shopping centers. Avoid standalone ATMs in remote locations, as they may be more susceptible to tampering.

Before inserting your card, check for any suspicious devices attached to the machine. Cover the keypad when entering your PIN to prevent theft. These small steps can protect your transaction and keep your funds secure.

How to Avoid Unnecessary ATM Fees

ATM fees can add up quickly, especially if you’re withdrawing cash frequently. To minimize costs, use ATMs affiliated with major banks, as they often charge lower fees. Some international banks also offer fee-free withdrawals for their customers.

Here’s a comparison of ATM options:

| ATM Location | Fee | Security Level |

|---|---|---|

| Bank ATMs | Low | High |

| Standalone ATMs | High | Medium |

| Airport ATMs | Very High | Low |

What to Do If Your Card Is Declined

If your card is declined, don’t panic. First, check your account balance to ensure you have sufficient funds. Next, verify that your card is enabled for international use by contacting your bank.

In case of a transaction error, keep the receipt and contact your bank immediately. They can help resolve the issue and ensure your card is working properly for future withdrawals.

Balancing Convenience and Cost

To avoid frequent atm fees, withdraw larger amounts less often. This reduces the number of transactions and keeps your costs low. However, always carry only what you’ll need for the day to minimize risk.

By following these tips, you can manage your cash effectively and enjoy a stress-free experience. Plan ahead, stay informed, and choose the right ATMs to make the most of your trip.

Practical Tips for Everyday Spending in Mali

Everyday spending in Mali requires a mix of cash and card for flexibility. Whether you’re exploring local markets or hopping in a taxi, knowing how to manage your spending ensures a smooth experience.

In markets, small shops, and rural areas, cash is the preferred payment method. Carrying smaller denominations like 500 or 1,000 XOF notes is helpful for quick purchases. For larger expenses in urban areas, a card mali option like the Wise Multi-Currency Card can be a lifesaver.

Navigating Markets, Tipping, and Small Purchases

Markets are a vibrant part of daily life, and bargaining is common. Start by offering half the asking price and negotiate from there. Tipping is appreciated but not mandatory. For taxi rides, rounding up the fare is a polite gesture.

Here’s a quick guide to typical costs:

- Street food: 500–1,000 XOF per meal

- Taxi ride: 1,000–2,000 XOF for short distances

- Local souvenirs: 2,000–5,000 XOF depending on the item

Using a travel card alongside cash ensures you’re prepared for any situation. For example, the Wise card supports XOF transactions with low fees, making it a smart choice for spending in Mali.

“A mix of cash and card gives you the flexibility to handle any transaction, from small purchases to larger expenses.”

To keep track of your spending, consider using budgeting apps like Monzo or Wise. These tools provide real-time updates and help you stay within your budget. By planning ahead and staying informed, you can enjoy your trip without financial stress.

Planning Your Travel Money Strategy Before Departure

Planning your travel money strategy before departure can save you time and money. A well-thought-out plan ensures you’re prepared for any financial situation during your trip. Start by creating a detailed budget that includes daily expenses, transportation, and activities.

Converting enough funds to XOF before leaving or upon arrival is crucial. This allows you to have local cash on hand for immediate needs like transportation or meals. Use reliable currency exchange services to get the best rates and avoid high fees.

Setting up and verifying your travel card and bank accounts is another essential step. Ensure your debit and credit cards are enabled for international use. Contact your bank to confirm any fees or restrictions that may apply.

Careful pre-trip planning minimizes the impact of high fees and unexpected issues. Review current exchange rates and book financial products in advance. This proactive approach helps you manage your spend xof efficiently and avoid last-minute stress.

“A well-planned travel money strategy ensures you’re prepared for any financial situation, making your trip smoother and more enjoyable.”

Here are some practical tips to enhance your travel money strategy:

- Create a detailed budget that includes all expected expenses.

- Convert some funds to XOF before departure for immediate needs.

- Set up and verify your travel card and bank accounts for international use.

- Review current exchange rates and book financial products in advance.

- Monitor your spending using budgeting apps to stay within your budget.

By following these steps, you can enjoy a stress-free trip with a well-managed travel money strategy. Plan ahead, stay informed, and make the most of your journey.

Mali: Ultimate Travelers Guide to Currencies & Payments – Recap & Conclusion

Managing your finances while traveling doesn’t have to be stressful. By setting a budget in advance and monitoring exchange rates, you can make the most of your funds. This ensures you’re prepared for any situation, whether you’re exploring markets or dining out.

Setting a Budget and Managing Exchange Rates

Start by estimating your daily expenses and converting some funds before your trip. This helps you avoid high fees at airports or hotels. Using a reliable bank or currency exchange service ensures you get the best rates. Apps like Wise or XE can help you track live rates and make informed decisions.

Combining Payment Methods for Flexibility

Carrying a mix of cash and cards is the smartest way to handle expenses. Cash is ideal for small purchases, while credit or travel cards work well for larger transactions. This combination ensures you’re covered in both urban and rural areas.

By planning ahead and staying informed, you can enjoy a seamless travel experience. Prepare your financial strategy in advance to avoid surprises and focus on making memories.

The above is subject to change.

Check back often to TRAVEL.COM for the latest travel tips and deals.

0 Comments