✓ Accommodations✓ Flights✓ Rental Cars

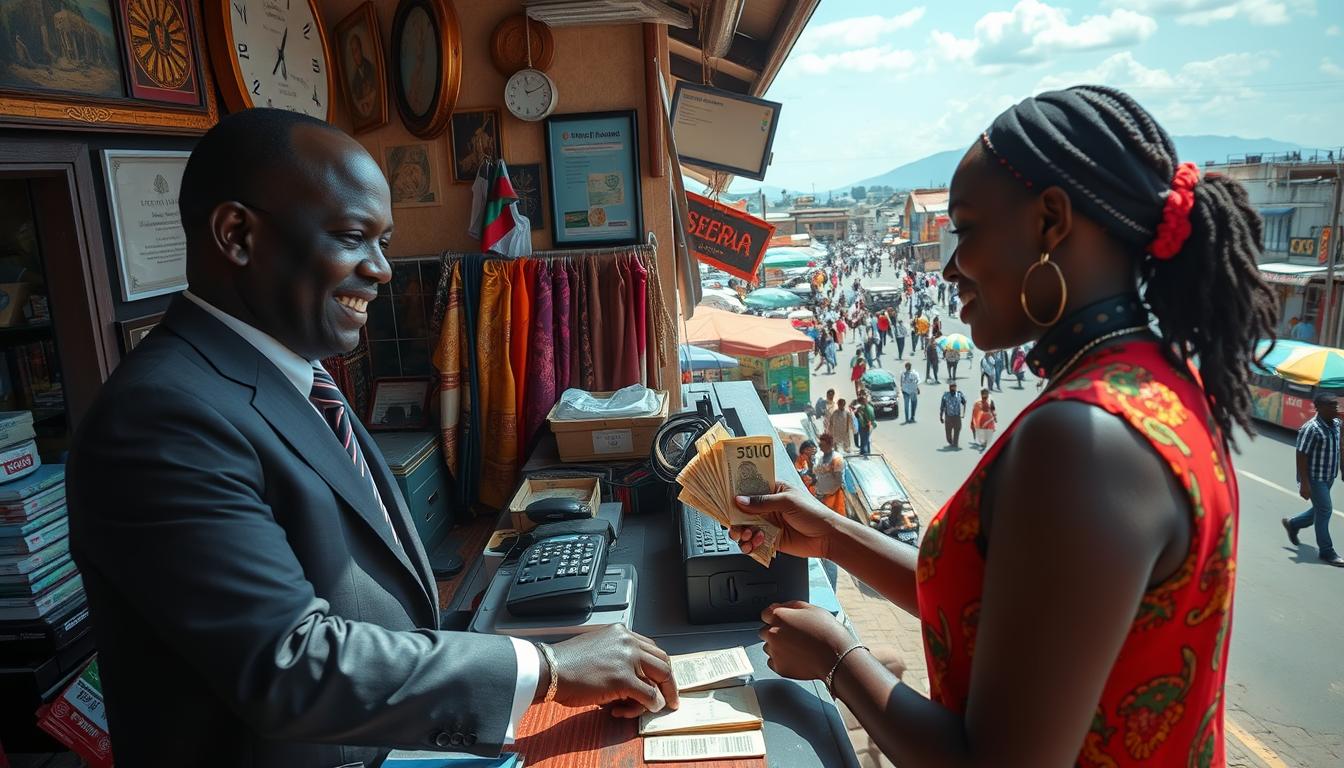

Did you know that over 70% of transactions in Sierra Leone are still conducted in cash? This surprising fact highlights the importance of understanding how to manage your money effectively when visiting this vibrant country. Whether you’re planning a short trip or an extended stay, knowing the ins and outs of local payments can save you time and money.

Using a travel money card like Wise or Monzo can be a game-changer. These cards offer low fees and secure transactions, making them a smart choice for travelers. They also allow you to hold multiple currencies, which is perfect for navigating the local cash economy.

Before you go, it’s essential to plan ahead. Check the exchange rates and make sure you have enough cash for daily expenses. While credit cards are rarely accepted, ATMs in major cities like Freetown can be a reliable option. By preparing in advance, you can focus on enjoying your trip without worrying about payment hassles.

Understanding Sierra Leone’s Currency Landscape

Navigating the currency system in Sierra Leone can be straightforward with the right preparation. The official currency is the Leone (SLL), and it’s essential to familiarize yourself with its denominations. Notes come in 10,000, 5,000, 2,000, and 1,000 SLL, while coins are available in 500, 200, 100, and 50 SLL.

Exchange rates play a significant role in managing your money effectively. As of recent data, $1 equals approximately 10,155 SLL. To get the best rates, aim for mid-market exchanges and avoid airport kiosks, which often charge higher fees.

Cash is king in Sierra Leone, with most transactions conducted in Leone. While credit cards are rarely accepted, ATMs in major cities like Freetown offer a reliable way to withdraw local currency. Make sure to notify your bank before your trip to avoid issues with international withdrawals.

Exchanging foreign currency is best done at banks like Rokel Commercial Bank or Sierra Leone Commercial Bank. They operate Monday to Friday, with some branches open on Saturdays. Remember, only newer dollar bills are accepted for exchange, so check your cash before you go.

Understanding the local currency landscape not only saves you from extra costs but also ensures a smoother travel experience. Plan ahead, carry enough cash, and use ATMs wisely to make the most of your time in this vibrant country.

Why a Travel Money Card is Essential for Your Trip

Traveling with a dedicated money card can transform your experience in Sierra Leone. These cards offer a secure and convenient way to manage your finances, ensuring you focus on enjoying your trip rather than worrying about payments.

Secure and Convenient Transactions

One of the biggest advantages of a travel money card is enhanced security. Unlike linking to your everyday bank account, these cards protect your primary account details. This means your cash is safe even if the card is lost or stolen.

Many cards, like Wise and Chime, also support contactless payments and mobile wallet compatibility. This makes it easy to pay for items at restaurants, hotels, or even taxis without carrying large amounts of cash.

Locking in Exchange Rates Before Departure

Another key benefit is the ability to lock in exchange rates before your trip. Providers like Wise offer mid-market rates, minimizing sudden fee changes and unfavorable conversions. This can save you money and reduce stress during your travels.

Here’s a quick comparison of popular travel money cards:

| Card | Key Features | Fees |

|---|---|---|

| Wise | Mid-market rates, multi-currency support | Low ATM fees |

| Chime | Fee-free spending, mobile app | No foreign transaction fees |

| Monzo | Budget tracking, instant notifications | Free ATM withdrawals abroad |

By using a travel money card, you can avoid carrying large amounts of cash and enjoy secure, hassle-free transactions. It’s a smart way to make the most of your time in Sierra Leone.

Top Travel Money Cards for Sierra Leone

Choosing the right travel money card can make your trip smoother and more cost-effective. These cards are designed to help you manage your finances abroad with ease. Whether you’re looking for low fees, secure transactions, or multi-currency support, there’s a card for every traveler.

Wise Multi-Currency Card Overview

The Wise Multi-Currency Card is a top choice for international travelers. It allows you to hold and convert over 50 currencies at the mid-market exchange rate. This means you avoid hidden fees and get the best value for your money.

With Wise, you can also withdraw cash from ATMs up to a certain limit without hefty fees. The card is linked to an easy-to-use app, making it simple to track your spending and manage your budget.

Comparing Chime, Monzo, and Netspend Offerings

When it comes to travel money cards, Chime, Monzo, and Netspend each have unique features. Chime stands out with its no foreign transaction fees, making it a budget-friendly option. Monzo offers free ATM withdrawals abroad, which is perfect for frequent travelers.

Netspend provides a range of prepaid card options, ideal for those who want to control their spending. Here’s a quick comparison to help you decide:

| Card | Key Features | Fees |

|---|---|---|

| Chime | No foreign transaction fees, mobile app | Low ATM fees |

| Monzo | Free ATM withdrawals, budget tracking | No monthly fees |

| Netspend | Prepaid options, customizable limits | Reload fees apply |

Each card has its strengths, so consider your travel needs before making a choice. Whether you prioritize low fees, convenience, or flexibility, there’s a card that fits your style.

Sierra Leone: Ultimate Travelers Guide to Currencies & Payments

Effective financial planning can make your visit to Sierra Leone seamless and enjoyable. This guide is designed to help you navigate the local payment systems with confidence, ensuring you focus on exploring this vibrant country rather than worrying about money.

So far, we’ve covered the essentials of managing your finances in Sierra Leone. From understanding the local currency to choosing the right travel money card, these tips are your roadmap to a hassle-free trip. Remember, cash is king here, but using a reliable card can save you time and fees.

Planning ahead is crucial. Whether it’s exchanging currency at the right places or notifying your bank about international withdrawals, these steps ensure financial security. By recapping these key points, we’re reinforcing the importance of preparation for a smooth travel experience.

As we move forward, we’ll dive deeper into topics like minimizing transaction fees and navigating local banking options. This guide is your comprehensive resource for all things related to currencies and payments in Sierra Leone. Stay tuned for more practical advice to make your trip unforgettable.

How to Choose the Best Travel Money Card

Selecting the right travel money card can make your trip smoother and more cost-effective. With so many options available, it’s important to focus on features that match your travel needs. Here’s how to evaluate your choices and pick the best card for your journey.

Key Features to Consider

When choosing a card, look for features that enhance convenience and security. A good card should offer low fees, multi-currency support, and easy access to funds. Mobile app integration is another plus, allowing you to track spending and manage your budget on the go.

Security is crucial. Opt for cards with fraud protection and the ability to lock or unlock your card instantly. This ensures your money stays safe, even if the card is lost or stolen.

Assessing Fees and Exchange Rates

Fees can quickly add up, so transparency is key. Compare ATM withdrawal fees, foreign transaction fees, and monthly maintenance costs. Some cards, like Wise, offer mid-market exchange rates, saving you money on currency conversions.

Always review the terms and conditions before committing. Look for hidden fees or restrictions that could impact your travel experience. By doing your homework, you can avoid unnecessary charges and enjoy a hassle-free trip.

Exchanging Currency: From USD to Sierra Leonean Leone

Converting USD to Sierra Leonean Leone doesn’t have to be complicated. With the right approach, you can save time and avoid unnecessary fees. Whether you’re planning ahead or exchanging on the go, understanding your options is key.

One of the best ways to get local currency is through ATMs. Major cities like Freetown have reliable machines, but always notify your bank before your trip. This ensures your card works internationally and avoids unexpected issues.

If you prefer to exchange cash, banks like Rokel Commercial Bank offer competitive rates. Avoid airport kiosks, as they often charge higher fees. Remember, only newer dollar bills are accepted for exchange, so check your cash beforehand.

Using a travel money card can also simplify the process. Cards like Wise and Monzo offer mid-market exchange rates, saving you money on conversions. They’re secure, convenient, and perfect for managing multiple currencies.

Planning ahead is crucial. Compare rates online before your trip and consider exchanging a small amount of cash for immediate expenses. By taking these steps, you’ll ensure a smooth and cost-effective currency exchange experience.

Paying Safely and Securely in Sierra Leone

Staying safe while making payments in Sierra Leone is easier than you might think. With the rise of contactless and mobile wallet options, you can enjoy secure and convenient transactions throughout your trip. These methods not only reduce the risk of fraud but also make everyday purchases hassle-free.

Using Contactless and Mobile Wallets

Contactless payments are becoming increasingly popular in Sierra Leone, especially in larger cities like Freetown. Many hotels, restaurants, and shops now accept mobile wallets like Apple Pay and Google Pay. These options are fast, secure, and eliminate the need to carry large amounts of cash.

To use a mobile wallet, simply link your travel money card to the app. This allows you to make payments with just a tap of your phone. It’s a great way to manage your budget while keeping your funds safe. Plus, you’ll avoid foreign transaction fees that often come with traditional credit cards.

Safety Tips for Digital Payments

While digital payments are convenient, it’s important to follow best practices to protect your money. Always use secure Wi-Fi networks when making transactions. Avoid sharing your card details or PIN with anyone. If your phone is lost or stolen, you can instantly lock your mobile wallet through the app.

Here’s a quick comparison of popular mobile wallet options:

| Option | Key Features | Security Tips |

|---|---|---|

| Apple Pay | Works with iPhone and Apple Watch | Enable Face ID or Touch ID |

| Google Pay | Compatible with Android devices | Use a strong password |

| Samsung Pay | Supports magnetic stripe terminals | Set up biometric authentication |

By using these tools, you can enjoy a seamless payment experience while minimizing risks. Whether you’re dining at a restaurant or shopping for souvenirs, digital payments offer a modern and secure way to handle your finances in Sierra Leone.

Minimizing International Transaction Fees

Saving money on international fees is easier than you think. With the right strategies, you can avoid unnecessary charges and keep more cash in your pocket. Whether you’re using a travel money card or exchanging currency, planning ahead is key.

One of the best ways to reduce fees is by choosing a card with low or no foreign transaction fees. Cards like Wise and Chime offer competitive rates and transparent fee structures. This can save you up to 3% on every purchase abroad.

Here are some tips to minimize fees during your trip:

- Compare card options before your trip to find the best rates.

- Avoid using ATMs that charge high withdrawal fees.

- Plan your currency exchanges in advance to sidestep dynamic fee increases.

- Notify your bank about international travel to prevent card issues.

Another smart move is to use a card that supports multiple currencies. This allows you to lock in exchange rates before your trip, avoiding unfavorable conversions. Apps like Wise and Monzo make it easy to track spending and manage your budget.

By following these steps, you can focus on enjoying your trip without worrying about hidden costs. A little preparation goes a long way in saving money and ensuring a smooth travel experience.

The Benefits of Prepaid Travel Cards

Prepaid travel cards are a smart choice for managing your money abroad. They offer a secure and convenient way to handle expenses while traveling. Unlike traditional credit cards, prepaid options allow you to pre-load funds in multiple currencies, giving you better control over your budget.

One of the biggest advantages is the ability to lock in an exchange rate before your trip. This saves you from sudden rate changes and helps you avoid extra costs. With a prepaid card, you can also minimize fees, as many providers offer low or no foreign transaction charges.

Prepaid cards are also a safer option. Since they aren’t linked to your everyday bank account, your primary funds remain protected. If your card is lost or stolen, you can quickly lock it through the provider’s app. This reduces the risk of fraud and gives you peace of mind during your travels.

Here’s how prepaid cards can enhance your trip:

- Budget control: Pre-load only what you need to avoid overspending.

- Security: Protect your main bank account from potential risks.

- Convenience: Access multiple currencies with a single card.

Whether you’re exploring a bustling city or relaxing on a remote beach, a prepaid travel card ensures your finances are in order. It’s a practical tool for any traveler looking to simplify their payment process and focus on enjoying their journey.

Navigating ATM Withdrawals and Local Banking Options

Accessing cash during your trip doesn’t have to be stressful with the right preparation. In Sierra Leone, ATMs are available in major cities like Freetown, but they can be scarce in rural areas. Knowing how to use them responsibly can save you time and money.

Most ATMs accept international cards, but it’s wise to notify your bank before your trip. This prevents issues with international withdrawals. Keep in mind that ATM limits and fees vary, so plan your withdrawals to avoid repeated charges.

For travelers who prefer digital methods, local banking alternatives are available. Some banks offer mobile apps for easy account management. These apps allow you to check balances, transfer funds, and even pay bills without visiting a branch.

Here are some tips to make the most of your ATM experience:

- Use ATMs in secure locations, such as banks or shopping centers.

- Withdraw larger amounts to minimize transaction fees.

- Carry a backup card in case of emergencies.

By following these steps, you can ensure a smooth and cost-effective way to access cash during your trip. Whether you’re exploring bustling cities or remote areas, being prepared makes all the difference.

Planning Your Travel Budget for Sierra Leone

Planning your travel budget for Sierra Leone ensures a stress-free and enjoyable trip. Knowing your expenses in advance helps you avoid overspending and focus on exploring this vibrant country. Start by estimating daily costs for meals, transport, and activities.

Here’s a breakdown of typical expenses:

- Meals: Local dishes like plasas cost around 50 Leones, while modern restaurants charge 200-300 Leones per meal.

- Transport: Tuk-tuk rides range from $1 to $4, and private car hire can cost $75-$150 per day.

- Accommodation: Expect to pay around $75 per night for a hotel stay.

Using a travel money card is a smart way to stick to your budget. Pre-load funds in multiple currencies to avoid unfavorable exchange rates. Cards like Wise and Monzo offer low fees and secure transactions, making them ideal for managing your money abroad.

Here are some tips to avoid overspending:

- Track your daily expenses using a mobile app linked to your card.

- Withdraw larger amounts from ATMs to minimize transaction fees.

- Set aside an emergency fund for unexpected costs.

By planning ahead and monitoring your spending, you can enjoy your trip without financial stress. Whether you’re dining at a local restaurant or exploring Freetown, a well-planned budget ensures a smooth and memorable experience.

Arrival and Airport Payment Strategies

Arriving in Sierra Leone can be a smooth experience if you plan your payment strategies wisely. From avoiding high exchange rates to managing the SecuriPass fee, a little preparation goes a long way. Here’s how to navigate airport payments like a pro.

Tips to Avoid Costly Airport Exchange Rates

Airport currency exchange kiosks often charge higher fees and offer less favorable rates. To save money, consider exchanging your currency before your trip. Banks and online providers like Wise offer better rates and lower fees.

Another smart option is to use a travel money card. These cards allow you to lock in exchange rates in advance, avoiding last-minute surprises. They’re also safer than carrying large amounts of cash.

Managing the Airport SecuriPass Fee

All travelers arriving or departing from Sierra Leone must pay a $25 SecuriPass fee. This fee is mandatory and covers airport security costs. To avoid delays, make sure you have the exact amount in cash or a credit card ready.

Here’s a quick guide to help you manage this fee:

| Payment Method | Tips |

|---|---|

| Cash | Carry small bills to avoid issues with change. |

| Credit Card | Notify your bank to ensure international transactions are approved. |

| Travel Money Card | Pre-load funds to cover the fee and other expenses. |

By planning ahead and choosing the right payment methods, you can start your trip on the right foot. Whether it’s avoiding high fees or managing mandatory costs, these strategies ensure a stress-free arrival in Sierra Leone.

Local Payment Etiquette and Cultural Insights

Understanding local payment customs can make your trip to Sierra Leone more enjoyable and respectful. In this vibrant country, cash is often preferred, especially in markets and smaller establishments. However, knowing when and how to use your card can save you time and effort.

Tipping is appreciated but not always expected. In restaurants, a 10% tip is customary if service isn’t included. For taxi drivers, rounding up the fare is a polite gesture. Street vendors and service providers may not expect tips, but a small token of appreciation can go a long way.

When negotiating prices at markets, always remain polite and respectful. Haggling is common, but it’s important to keep the interaction friendly. Start by offering half the asking price and work your way up. This approach shows you’re serious but fair.

Using a card is more accepted in hotels and upscale restaurants. However, smaller businesses and rural areas may only accept cash. Always carry enough local currency to avoid inconvenience. ATMs are available in major cities, but they may have withdrawal limits.

Here’s a quick guide to payment methods in Sierra Leone:

| Payment Method | Best For | Tips |

|---|---|---|

| Cash | Markets, street vendors, rural areas | Carry small denominations for convenience. |

| Card | Hotels, upscale restaurants | Notify your bank before your trip. |

| Mobile Wallet | Urban areas, contactless payments | Link to a travel money card for security. |

By following these cultural insights, you’ll navigate payments smoothly and respectfully. Whether you’re tipping a taxi driver or haggling at a market, these tips ensure a positive experience throughout your travel.

Visa, Entry Requirements, and Health Considerations

Planning your trip to Sierra Leone starts with knowing the visa and health rules. Ensuring you meet these requirements is the first step to a smooth and enjoyable journey. Whether you’re visiting for a short stay or an extended period, having the right documents and health precautions is essential.

Staying Up-to-Date with Entry Regulations

Before you travel, check the latest entry requirements for Sierra Leone. Visa-on-arrival options are available for many travelers, but it’s best to confirm eligibility in advance. Single-entry visas are common, but if you plan to stay longer, explore extended stay options.

Here’s what you need to prepare:

- Valid passport: Ensure it has at least six months of validity beyond your stay.

- Proof of accommodation: Provide a hotel reservation or invitation from a host.

- Onward travel proof: A return ticket is mandatory.

Health regulations are equally important. A yellow fever vaccination is required, especially if you’re arriving from a country at risk for the disease. Travel insurance is also highly recommended to cover medical emergencies, evacuation, and other unexpected costs.

Here’s a quick guide to visa processing times and fees:

| Processing Time | Service Fee |

|---|---|

| 1 day (Emergency) | $249.00 |

| 2 days (Rush) | $179.00 |

| 4 days (Standard) | $119.00 |

By preparing these documents and staying informed, you can ensure a seamless entry process. Double-check the latest updates on the official immigration website before your trip to avoid any last-minute surprises.

Transportation and Payment Options in Freetown

Exploring Freetown’s transportation options can make your trip more convenient and enjoyable. From taxis to tuk-tuks and water taxis, the city offers a variety of ways to get around. Knowing the best methods and payment options ensures a smooth experience.

Using Taxis, Tuk-Tuks, and Water Taxis

Taxis are a reliable way to travel in Freetown. They’re widely available and can be hailed on the street or booked in advance. Fares typically range from $1 to $4 for short distances, but it’s always a good idea to negotiate the price before starting your journey.

Tuk-tuks, locally known as KeKes, are a popular and affordable option. These motorized tricycles are perfect for short trips and cost around $1 to $2. They’re faster than taxis in heavy traffic, making them a favorite among locals and travelers alike.

For longer distances, water taxis are a great choice. They connect Lungi Airport to Freetown, taking about 30 minutes. This is much faster than the government ferry, which can take over an hour. Water taxis cost around $20 per person, and you can pay in cash or with a card at some providers.

Payment Methods and Tips

Cash is the most common payment method for transportation in Freetown. Make sure to carry small bills, as drivers may not have change for larger denominations. Some taxis and water taxis accept credit cards, but it’s best to confirm before your trip.

Here’s a quick guide to transportation costs and payment options:

| Transport Option | Average Cost | Payment Methods |

|---|---|---|

| Taxi | $1 – $4 | Cash, Card (rare) |

| Tuk-Tuk (KeKe) | $1 – $2 | Cash |

| Water Taxi | $20 | Cash, Card (some providers) |

By understanding these options, you can navigate Freetown with ease. Whether you’re hopping in a tuk-tuk or taking a water taxi, knowing the costs and payment methods ensures a hassle-free trip.

Conclusion

Managing your finances while exploring a new destination doesn’t have to be stressful. By using a travel money card, you can avoid unnecessary fees and ensure secure transactions. These cards simplify payments and help you stay within budget.

Planning ahead, such as locking in exchange rates and carrying alternative payment methods, makes your journey smoother. Whether you’re navigating local markets or dining at restaurants, these tips ensure financial ease.

Take these steps to focus on enjoying your trip without worrying about money. With the right preparation, you can make the most of your experience and ensure a hassle-free adventure.

The above is subject to change.

Check back often to TRAVEL.COM for the latest travel tips and deals.