✓ Accommodations✓ Flights✓ Rental Cars✓ Tours & Activities

Did you know that the Zimbabwe Dollar once reached a staggering 100 trillion dollars in value due to hyperinflation? This fascinating history makes it essential to understand the country’s current currency landscape before you travel.

Today, Zimbabwe uses a mix of the US dollar and the newly introduced gold-backed ZiG currency. The official exchange rate is ZiG 26.33 to US$1, but a black market rate exists between ZiG 40 and 50 per US$1. This guide will help you navigate these complexities with ease.

Whether you’re carrying cash or relying on cards, knowing the best payment methods is crucial. The US dollar remains the dominant currency, but understanding local bank practices and fees can save you time and money. Let’s dive into the details to ensure your trip is smooth and stress-free.

Introduction: Getting Ready for Your Zimbabwe Adventure

Planning a trip to Zimbabwe? Here’s what you need to know about navigating its unique currency system. This guide is tailored for international visitors, especially those from the United States, to help you prepare for a seamless journey.

Who This Guide is For

If you’re traveling to Zimbabwe for the first time, this guide is your go-to resource. Whether you’re a solo adventurer or traveling with family, understanding the local payment methods and currency exchange will save you time and money.

What to Expect on Your Trip

Zimbabwe’s payment environment can be challenging at times. While the US dollar is widely accepted, you may encounter issues with card transactions due to network outages. Carrying small denominations of cash is highly recommended.

Here’s a quick overview of what to prepare:

- Visa Requirements: Ensure your passport has at least six months of validity and three blank pages. A visa on arrival is available for 30 days, with a fee payable in US dollars.

- Safety Tips: Be cautious in crowded areas and avoid displaying large amounts of cash. Keep your valuables secure, especially after dark.

- Payment Methods: While cards are accepted in major cities, cash is king in remote areas. Consider obtaining a travel card for added convenience.

To help you plan better, here’s a table summarizing key travel essentials:

| Item | Details |

|---|---|

| Passport Validity | 6 months minimum, 3 blank pages |

| Visa Fee | Payable in US dollars |

| Preferred Currency | US dollar (small denominations) |

| Safety Tips | Avoid crowded areas, secure valuables |

With these tips in mind, you’re ready to embark on your Zimbabwe adventure. Stay informed, stay safe, and enjoy your trip!

Historical Evolution of Zimbabwe’s Currency

The story of Zimbabwe’s currency is a fascinating journey of resilience and transformation. From its early days to the present, the country’s monetary system has faced challenges that reshaped its economy and influenced how locals and visitors handle money.

From the Rhodesian Dollar to the Zimbabwe Dollar

After gaining independence in 1980, Zimbabwe introduced its own currency, the Zimbabwe Dollar, replacing the Rhodesian Dollar. Initially, its value was comparable to the US dollar, offering stability and confidence in the new system.

However, the economic landscape began to shift. By the late 1990s, the country faced severe challenges, leading to a series of changes in its monetary policy. These shifts marked the beginning of a turbulent era for the Zimbabwe Dollar.

The Impact of Hyperinflation and Currency Redenomination

Hyperinflation became a defining feature of Zimbabwe’s economy in the 2000s. At its peak, prices doubled every 24.7 hours, rendering the local currency nearly worthless. In 2008, the infamous 100-trillion-dollar banknote was issued, symbolizing the extreme devaluation of the dollar.

To address this crisis, the government implemented multiple redenominations. The first occurred in 2006, introducing the second Zimbabwe Dollar. A second redenomination followed in 2008, creating the third Zimbabwe Dollar. Despite these efforts, hyperinflation persisted, leading to the eventual abandonment of the local currency in 2009.

Key milestones in this period include:

- 2006: First redenomination of the Zimbabwe Dollar.

- 2008: Introduction of the 100-trillion-dollar banknote.

- 2009: Adoption of a multi-currency system, primarily using the US dollar.

These events had a lasting impact on how locals and tourists approach money. Today, the US dollar remains widely accepted, but understanding this history helps you navigate the country’s unique financial landscape with confidence.

Current Currency Scenario: Zimbabwe Gold Dollar (ZiG)

Navigating the currency system in this region can be tricky, especially with the recent introduction of the ZiG. This gold-backed currency, launched in April 2024, aims to restore trust in the local financial system. However, the dual-exchange system adds complexity to your travel planning.

Official Exchange Rates versus the Black Market

The official exchange rate for the ZiG is set at 26.33 per US dollar. However, a parallel market exists, where rates can climb as high as 40 to 50 ZiG per US dollar. This discrepancy arises from the high demand for US dollars, which remain the preferred medium for transactions.

While banks offer the official rate, many locals and businesses turn to the black market for better deals. This can create confusion for travelers, especially when prices fluctuate based on the exchange rate used.

Understanding the Role of the US Dollar

Despite the introduction of the ZiG, the US dollar continues to dominate everyday transactions. From hotels to markets, most vendors prefer payment in USD. This preference stems from the stability and global acceptance of the dollar, which helps avoid the volatility associated with the local currency.

For travelers, carrying small denominations of US dollars is highly recommended. This ensures smooth transactions, especially in remote areas where card payments may not be accepted.

Here are a few tips to manage your finances effectively:

- Monitor Exchange Rates: Stay updated on both official and black market rates to avoid overpaying.

- Carry Cash: While cards are accepted in cities, cash is essential for smaller towns and rural areas.

- Use Reliable Sources: Exchange money at authorized banks or trusted dealers to avoid scams.

The introduction of the ZiG is a step toward stabilizing the local economy. However, the US dollar remains the safest and most convenient option for travelers. By staying informed and prepared, you can navigate the currency landscape with confidence.

Understanding Payment Options in Zimbabwe

Handling payments in this region requires careful planning and preparation. The right payment methods can save you time, money, and hassle during your trip. Here’s what you need to know to navigate the payment landscape effectively.

Using US Dollar Cash Effectively

Carrying cash in USD is essential for everyday transactions. While digital payments are growing, many vendors, especially in rural areas, prefer cash. Small denominations are particularly useful, as change is often scarce.

Here’s why cash is king:

- Wide Acceptance: Most businesses, from markets to hotels, accept USD.

- Convenience: Cash ensures smooth transactions, even during network outages.

- Flexibility: Small bills make it easier to pay for goods and services without overpaying.

However, be cautious when exchanging money. Stick to authorized banks or trusted dealers to avoid scams.

Credit and Debit Card Acceptance

While cards are accepted in major cities, their use comes with limitations. Visa and MasterCard are widely preferred, but American Express and Diners Club may not be accepted. Always carry a backup payment method, as card machines can be unreliable.

Here are some tips for using credit debit cards safely:

- Check for Fees: Some establishments charge extra for card transactions.

- Carry ID: You may need to show your passport or photo ID for verification.

- Monitor Transactions: Keep an eye on your account to avoid overcharging.

For added convenience, consider obtaining a travel card that supports USD transactions.

| Payment Method | Pros | Cons |

|---|---|---|

| US Dollar Cash | Widely accepted, no network issues | Risk of theft, need for small bills |

| Credit/Debit Cards | Convenient, secure | Limited acceptance, potential fees |

| Travel Money Card | Preloaded with USD, easy to use | May have withdrawal limits |

By understanding these payment options, you can manage your finances effectively and enjoy a hassle-free trip. Plan ahead, stay informed, and always have a backup plan.

Zimbabwe ATMs and Bank Withdrawals

Accessing cash during your travels can be a challenge, especially in regions with limited banking infrastructure. In this area, ATMs and bank services are crucial for managing your finances. However, understanding their limitations and planning ahead can save you from unexpected hassles.

ATM Availability and Withdrawal Limits

While ATMs are available in major cities, they may not always dispense cash reliably. Many machines dispense US dollars, but daily withdrawal limits are common. Some banks cap withdrawals at US$1000 per day, while others may have lower limits depending on your home bank’s policies.

It’s important to note that cash shortages and machine outages can occur. To avoid being stranded, always carry backup cash. Relying solely on ATMs is not advisable, especially in remote areas where access is limited.

Bank Services in Tourist Areas

In tourist hubs, reputable banks like Standard Bank, First Capital Bank, and Stanbic Bank offer reliable services. These institutions provide debit card support and can assist with larger transactions. However, be prepared for potential fees and ensure you have proper identification for verification.

Here’s a quick overview of what to expect when using bank services:

| Service | Details |

|---|---|

| ATM Withdrawals | Daily limit up to US$1000 |

| Bank Hours | Typically 8 AM to 3 PM, Monday to Friday |

| Identification | Passport or photo ID required |

| Additional Fees | May apply for certain transactions |

To manage your finances effectively, keep these tips in mind:

- Monitor Exchange Rates: Stay updated to ensure you’re getting the best value for your withdrawals.

- Carry Backup Cash: Always have extra US dollars on hand for emergencies.

- Use Reputable Banks: Stick to well-known institutions to avoid scams and ensure smooth transactions.

By understanding the local banking system and planning ahead, you can ensure a stress-free experience while accessing cash during your trip.

Tips for Safe Handling of Cash and Currency Exchange

Ensuring the safety of your money while traveling is crucial, especially in regions with unique financial systems. Proper handling of cash and understanding the currency landscape can protect you from fraud and unnecessary fees. Here’s how you can stay secure and make the most of your payments.

How to Avoid Fraud and Overcharging

Fraudulent practices, such as the sale of outdated banknotes or incorrect exchange rates, are common in some areas. To avoid scams, always transact with officially licensed dealers. Reputable banks or bureaus de change are your safest options.

Here are some strategies to protect your money:

- Verify Exchange Rates: Use reliable sources to check current rates before making any transactions.

- Carry Small Denominations: Smaller bills reduce the risk of being overcharged or receiving counterfeit money.

- Keep Records: Maintain receipts and transaction details for reference in case of disputes.

Additionally, be cautious when using debit or credit cards. Monitor your account statements regularly to spot unauthorized charges. If you suspect fraud, report it immediately to your bank.

| Safety Tip | Why It’s Important |

|---|---|

| Use Licensed Dealers | Reduces the risk of fraud and ensures fair rates. |

| Carry Backup Cash | Provides a safety net during emergencies or card failures. |

| Monitor Transactions | Helps detect unauthorized charges quickly. |

By following these precautions, you can safeguard your money and enjoy a stress-free trip. Stay informed, stay vigilant, and always prioritize your financial security.

Guide to Exchanging Foreign Currency in Zimbabwe

Understanding how to exchange foreign currency can make your trip smoother and more cost-effective. Whether you’re carrying US dollars or another currency, knowing where and how to exchange it ensures you get the best rates and avoid unnecessary fees.

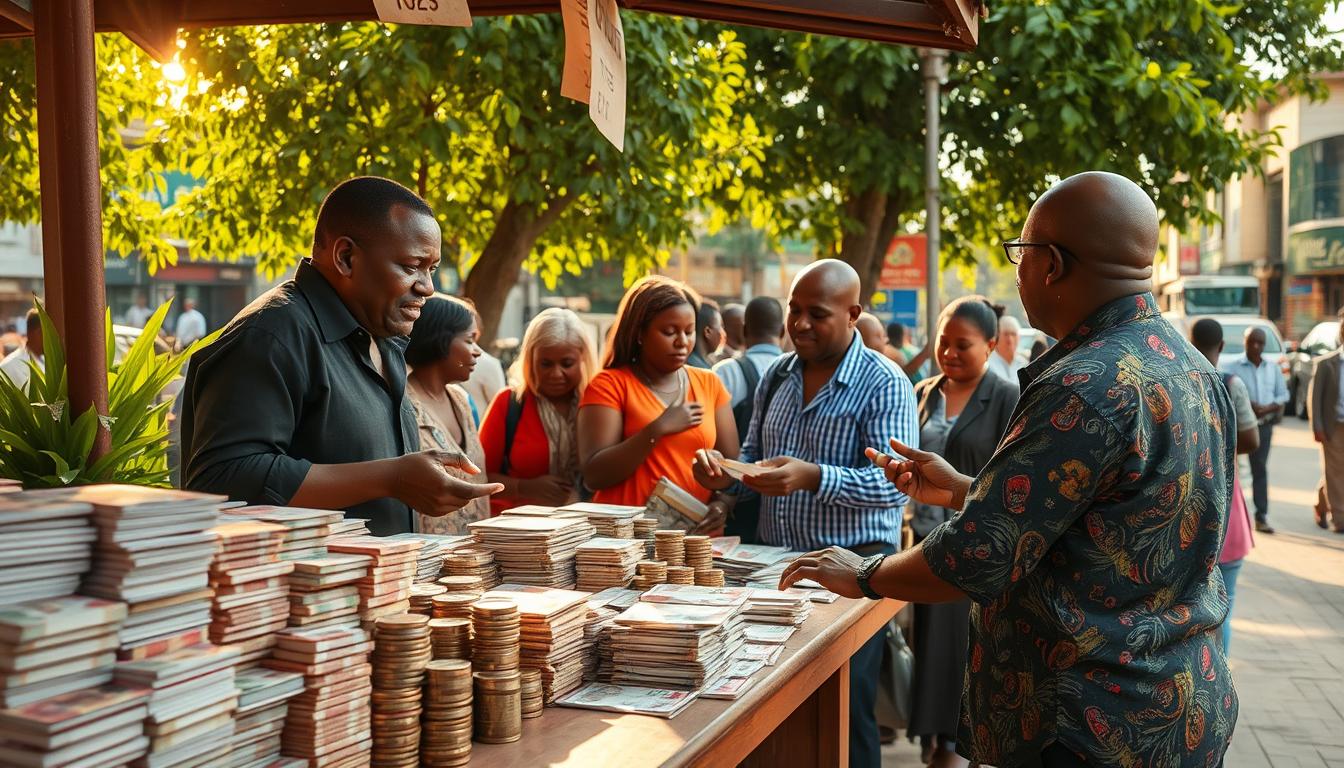

Where to Exchange Money Safely

When exchanging foreign currency, safety and reliability are key. Banks and licensed bureau de change are the most secure options. Institutions like Standard Bank and CBZ Sapphire House Branch offer competitive rates and transparent fees.

Here’s why these options are recommended:

- Transparency: Official dealers provide clear exchange rates and fees.

- Security: Transactions are monitored, reducing the risk of fraud.

- Convenience: Many banks offer additional services like card support and account management.

Official Dealers vs. Parallel Markets

While official dealers are safer, parallel markets often offer higher rates. However, these unofficial exchanges come with risks. Street-side dealers may provide outdated banknotes or incorrect rates, leading to financial losses.

Here’s a comparison of the two options:

| Channel | Pros | Cons |

|---|---|---|

| Official Dealers | Safe, transparent, reliable | Rates may be lower than the black market |

| Parallel Markets | Higher rates, quick transactions | Risk of fraud, lack of accountability |

To ensure a smooth experience, always check current exchange rates before finalizing any transaction. Reputable dealers in tourist hubs like Harare and Victoria Falls are your best bet for fair and secure exchanges.

By choosing trusted sources and staying informed, you can manage your foreign currency needs with confidence and ease.

Planning Your Travel Budget with Currency Concerns

Creating a realistic travel budget requires careful planning and flexibility. With fluctuating exchange rates and unpredictable costs, it’s essential to account for both daily expenses and unexpected financial needs. Here’s how you can plan effectively to ensure a stress-free trip.

Estimating Your Daily Expenses

Start by calculating your daily costs in US dollars. Meals, transportation, and accommodation are the primary expenses to consider. For example, a meal at a mid-range restaurant may cost around $10-$15, while local transport can range from $2-$5 per day.

Here’s a breakdown of typical tourism expenses:

- Accommodation: Budget hotels start at $30 per night, while luxury options can exceed $100.

- Meals: Street food is affordable at $2-$5, while restaurants charge $10-$20 per person.

- Transport: Public buses cost $1-$2, while private taxis range from $5-$10 per ride.

Pre-booking some services, like accommodation or tours, can help lock in prices and reduce uncertainty. Always confirm the exchange rate at the time of booking to avoid surprises.

Budgeting for Unexpected Costs

Unforeseen expenses are common during travel. A financial buffer of 10%-20% of your total budget is recommended to cover emergencies or sudden cost increases. For instance, medical expenses or last-minute transport changes can add up quickly.

Here are some tips to manage unexpected money needs:

- Carry Extra Cash: Keep a reserve of small US dollar bills for emergencies.

- Monitor Spending: Track your expenses daily to avoid overspending.

- Use Reliable Providers: Choose trusted services to minimize risks and additional costs.

By planning ahead and staying flexible, you can navigate the challenges of fluctuating currency and enjoy your trip without financial stress.

Navigating Payment Challenges in Remote Areas

Traveling to less-developed areas often comes with unique financial hurdles. While major cities like Harare and Victoria Falls offer a range of payment options, rural regions can be a different story. Here’s how to prepare for the unexpected and ensure smooth transactions wherever you go.

Payment Options in Non-Tourist Centers

In remote areas, cash is king. Many vendors and small businesses may not accept cards, and digital payment systems are often unreliable. Carrying small denominations of US dollars is essential, as change can be hard to come by.

Here’s what to expect:

- Limited Card Acceptance: While Visa and MasterCard are accepted in cities, rural areas often rely on cash-only transactions.

- Local Currency Preference: Some vendors may only accept the local currency, especially in markets or small shops.

- Network Issues: Internet and mobile networks can be spotty, making digital payments a risky option.

Strategies for Smooth Transactions

To avoid delays and extra fees, plan ahead. Here are some tips to keep in mind:

- Carry Enough Cash: Estimate your daily expenses and bring extra for emergencies.

- Use Reputable Exchanges: Stick to banks or licensed dealers to avoid scams when converting foreign currency.

- Prepare Alternatives: Have a mix of payment methods, including cash, cards, and mobile wallets.

By staying prepared and flexible, you can navigate the financial challenges of remote areas with confidence. Remember, a little planning goes a long way in ensuring a stress-free trip.

How to Use Digital and Travel Money Cards Effectively

Travel money cards are a game-changer for managing expenses abroad. They offer convenience, security, and often lower fees compared to traditional banking methods. Whether you’re a frequent traveler or planning a one-time trip, understanding how to use these cards can save you time and money.

Overview of Travel Money Cards

A travel money card is a prepaid or multi-currency card designed for international use. It allows you to load funds in multiple currencies, including USD, and spend or withdraw cash abroad without hefty fees. Popular options like Wise, Revolut, and Travelex offer competitive exchange rates and user-friendly features.

Here’s why these cards stand out:

- Low Fees: Many cards charge minimal or no foreign transaction fees.

- Multi-Currency Support: Hold and spend in over 50 currencies worldwide.

- Security: Chip and PIN technology, along with fraud monitoring, keeps your money safe.

Converting and Spending in US Dollars

If you’re traveling to a region where the USD is widely accepted, a travel money card can simplify your finances. These cards allow you to lock in favorable exchange rates before your trip, ensuring you get the most value for your money.

Here’s how to make the most of your card:

- Load USD: Preload your card with USD to avoid conversion fees during transactions.

- Monitor Rates: Use mobile apps to track real-time exchange rates and convert funds when rates are favorable.

- Spend Wisely: Use your card for purchases and withdrawals to minimize cash handling.

As one traveler shared,

“Using a travel money card saved me from worrying about exchange rates and hidden fees. It’s a must-have for any international trip.”

By choosing the right card and managing it effectively, you can enjoy a stress-free financial experience while exploring the world. Whether you’re shopping, dining, or booking tours, these cards offer the flexibility and security you need.

Essential Currency Tips for Popular Destinations

Exploring popular destinations like Victoria Falls requires a solid understanding of local payment practices. This region, known for its breathtaking landscapes, also has unique financial nuances that can impact your travel experience. Here’s how to navigate currency and payment challenges effectively.

Victoria Falls and Surrounding Areas

In Victoria Falls, the US dollar is widely accepted, but carrying small denominations is key. Many vendors struggle to provide change, especially for larger bills. To avoid delays, keep a mix of $1, $5, and $10 notes handy.

Here are some tips for handling currency in this area:

- Carry Cash: While cards are accepted in hotels and restaurants, smaller shops and markets prefer cash.

- Check Exchange Rates: Verify rates before exchanging money to ensure you’re getting a fair deal.

- Be Prepared for Rounding: Due to the absence of coins, prices are often rounded to the nearest dollar.

Payment Strategies for Hotels and Restaurants

Hotels and restaurants in Victoria Falls generally accept credit and debit cards, but it’s wise to confirm beforehand. Some establishments may charge a fee for card transactions, so carrying cash can save you extra costs.

Here’s what to expect when dining or staying in high-tourist areas:

| Service | Accepted Payment Methods |

|---|---|

| Hotels | USD cash, Visa, MasterCard |

| Restaurants | USD cash, Visa, MasterCard |

| Local Markets | USD cash only |

As one traveler noted,

“Always confirm payment options with your hotel or restaurant before your stay or meal. It saves time and avoids surprises.”

By following these strategies, you can enjoy a seamless experience in Victoria Falls and its surrounding areas. Stay prepared, stay informed, and make the most of your adventure.

Managing Currency Conversion and Exchange Rates

Keeping track of currency fluctuations can make or break your travel budget. Exchange rates can shift daily, impacting how much you spend on meals, accommodations, and activities. Staying updated ensures you get the best value for your money.

Staying Updated on the Latest Rates

Monitoring the exchange rate regularly is crucial. Even small changes can add up over time. For example, a 5% shift in the rate could mean paying significantly more for the same services.

Here’s why staying informed matters:

- Save Money: A favorable rate can reduce your overall expenses.

- Plan Ahead: Knowing the current exchange rate helps you budget accurately.

- Avoid Surprises: Sudden shifts won’t catch you off guard.

Using Mobile Apps for Real-Time Conversion

Modern tools make it easy to track exchange rates on the go. Apps like XE Currency and Revolut provide real-time updates, ensuring you always have the latest information.

Here’s how these apps can help:

- Instant Updates: Get notified of rate changes as they happen.

- Multi-Currency Support: Track multiple currencies simultaneously.

- Budgeting Tools: Plan your spending based on current rates.

As one traveler shared,

“Using a currency app saved me from overpaying during my trip. It’s a must-have for any international traveler.”

Best Practices for Transfers and Budgeting

When transferring funds, always compare fees and rates. Some services charge hidden costs, reducing the amount you receive. Opt for providers with transparent pricing and competitive exchange rates.

Here’s a quick guide to managing your money effectively:

| Service | Pros | Cons |

|---|---|---|

| Bank Transfers | Secure, reliable | High fees, slow processing |

| Online Platforms | Low fees, fast transfers | Limited currency options |

| Travel Cards | Multi-currency support, no fees | Withdrawal limits apply |

By staying informed and using the right tools, you can navigate currency conversion with confidence. Keep an eye on rates, avoid unnecessary fees, and make the most of your travel budget.

In-Depth: Zimbabwe: Ultimate Travelers Guide to Currencies & Payments

Understanding the nuances of handling money in a foreign country can make your trip smoother and more enjoyable. This guide has covered everything from the evolution of the local currency to practical tips for managing your finances. Here’s a summary of the key takeaways and final suggestions to ensure stress-free transactions.

Key Takeaways from the Ultimate Guide

The journey of Zimbabwe’s currency is a story of resilience. From hyperinflation to the introduction of the gold-backed ZiG, the financial landscape has seen significant changes. Today, the US dollar remains the dominant currency, but understanding the dual-exchange system is crucial.

Here’s a quick recap of the best practices:

- Carry Small Denominations: US dollars in $1, $5, and $10 bills are essential for smooth transactions.

- Use Reliable Payment Methods: While cards are accepted in cities, cash is preferred in rural areas.

- Monitor Exchange Rates: Stay updated on both official and black market rates to avoid overpaying.

Final Tips for Smooth Transactions

To ensure a hassle-free experience, follow these actionable tips:

- Avoid Scams: Only exchange money at licensed banks or trusted dealers to prevent fraud.

- Plan Your Budget: Account for daily expenses and unexpected costs to avoid financial stress.

- Use Digital Tools: Mobile apps like XE Currency can help you track real-time exchange rates.

Here’s a table summarizing the best practices for handling money:

| Tip | Why It’s Important |

|---|---|

| Carry Cash | Ensures smooth transactions in remote areas. |

| Use Reliable Banks | Reduces the risk of fraud and ensures fair exchange rates. |

| Monitor Spending | Helps you stay within budget and avoid overspending. |

By following these strategies, you can navigate the financial landscape with confidence. Keep this guide handy as a reference during your travels, and enjoy a stress-free trip!

Conclusion

Preparing for your journey involves more than just packing your bags—it’s about understanding the financial landscape to ensure a smooth experience. By planning ahead, you can avoid common challenges and focus on enjoying your travel.

Start by verifying visa requirements and ensuring your documents are in order. This step is crucial for a hassle-free entry. Next, familiarize yourself with local costs and exchange rates. Carrying small denominations of US dollars is highly recommended, especially in remote areas.

When it comes to payments, stick to reputable methods. Use reliable banks or licensed dealers for currency exchange to avoid scams. If you’re moving between borders, keep updated on any changes in accommodation or transportation fees.

With careful preparation and the right information, you can navigate the financial landscape with confidence. Whether you’re exploring Lake Kariba or crossing into South Africa, these tips will help you make the most of your time and money. Safe travels!

The above is subject to change.

Check back often to TRAVEL.COM for the latest travel tips and deals.