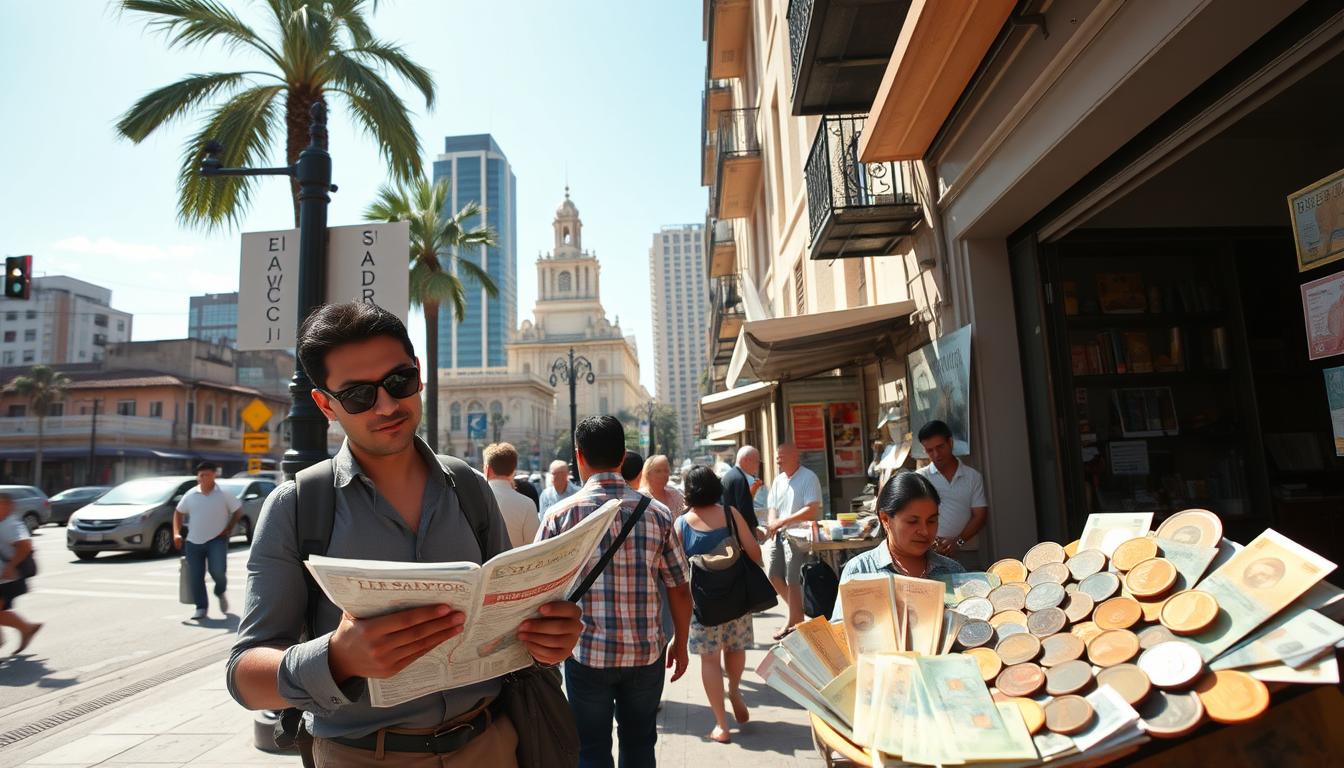

Did you know that this small Central American country is the first in the world to adopt Bitcoin as legal tender alongside the U.S. Dollar? This unique blend of traditional and digital currency makes managing your money here an exciting experience. Whether you’re exploring vibrant cities or relaxing on stunning beaches, understanding the local payment methods is key to a smooth trip.

Cash remains the most common way to pay for everyday transactions, especially in local markets and smaller towns. However, card and digital payments are growing in popularity, particularly in urban areas. Planning ahead ensures you’re prepared for both options during your travels.

This guide will help you navigate the country’s financial landscape with ease. From tips on carrying cash securely to using cards and digital wallets, you’ll find everything you need to make the most of your journey. Stay tuned for detailed advice on managing your money while enjoying the rich culture and breathtaking scenery of this beautiful destination.

Introduction and Travel Overview

Exploring this vibrant destination offers a mix of culture, nature, and innovation. Whether you’re wandering through bustling markets or relaxing on pristine beaches, every moment here is an adventure. Understanding how to manage your finances ensures a smooth and enjoyable trip.

Welcome to El Salvador

This Central American gem is known for its stunning landscapes and rich cultural heritage. From volcanic peaks to turquoise waters, the scenery is breathtaking. The warm hospitality of the locals adds to the charm, making it a must-visit destination.

Why Managing Currency Matters for Your Trip

Handling your money wisely is key to a hassle-free experience. Cash is widely used in local markets, public transportation, and small businesses. It’s essential for tipping and everyday transactions. However, card payments are increasingly accepted in urban areas, offering convenience and security.

Here’s a quick comparison of payment methods:

| Payment Method | Best For | Tips |

|---|---|---|

| Cash | Local markets, transport, tipping | Carry small bills for convenience |

| Cards | Urban areas, hotels, restaurants | Notify your bank before traveling |

Mixing cash and cards during your travel ensures you’re prepared for any situation. It’s a practical way to stay flexible while keeping your funds secure. By planning ahead, you can focus on enjoying the beauty and culture of this remarkable country.

El Salvador: Ultimate Travelers Guide to Currencies & Payments

Understanding local payment methods is essential for a smooth journey. This guide covers everything you need to know about managing your money while exploring this vibrant country. From exchanging currency to using ATMs and travel money cards, we’ve got you covered.

Here’s what you’ll learn:

- How to handle cash, cards, and digital payments efficiently.

- Tips to avoid extra fees by understanding local payment culture.

- A step-by-step approach to managing your funds abroad.

Whether you’re shopping at local markets or dining in urban restaurants, knowing your options ensures a hassle-free experience. This guide will help you stay prepared for any situation during your travel.

In the next sections, we’ll dive deeper into specific topics like using the U.S. Dollar, Bitcoin transactions, and navigating ATMs. Stay tuned for practical advice to make the most of your trip.

Understanding the Official Currency: U.S. Dollar & Bitcoin

This country offers a fascinating blend of traditional and modern payment methods. The U.S. Dollar is the primary currency, widely accepted for all transactions. Bitcoin, while innovative, is still finding its footing in everyday use. Knowing how to navigate both options will make your travel smoother.

The Role of the U.S. Dollar

The U.S. Dollar has been the official currency here since 2001. It’s fee-free and accepted everywhere, from bustling markets to upscale restaurants. Carrying smaller bills, like $1, $5, and $10, is ideal for local transactions. This ensures you’re prepared for any situation, whether you’re shopping or tipping.

How Bitcoin Fits Into Local Transactions

Bitcoin was introduced as legal tender in 2021, making this the first country to adopt it. However, its use is still limited to select businesses, primarily in urban areas. While it offers convenience for tech-savvy travelers, relying solely on Bitcoin may not be practical. It’s best to carry some cash as a backup.

Here’s a quick comparison to help you decide:

- U.S. Dollar: Widely accepted, no fees, ideal for all transactions.

- Bitcoin: Innovative but limited to certain businesses, best for tech enthusiasts.

By understanding these options, you can manage your money effectively and enjoy your travel without stress.

Navigating Cash Payments and Card Acceptance

Knowing how to handle payments can make your journey smoother and more enjoyable. In this vibrant country, cash and cards are both essential tools for navigating daily transactions. Understanding when to use each ensures you’re prepared for any situation.

When Cash is King

Cash remains the preferred method in rural areas and small businesses. It’s ideal for public transport, street vendors, and local markets. Carrying smaller bills ensures you’re ready for quick transactions or tipping.

For example, street food, bus fares, and small purchases are best handled with physical money. It’s also a good idea to keep some cash as a backup, especially in areas with limited card acceptance.

Using Cards in Urban and Tourist Areas

In cities and tourist hotspots, card payments are widely accepted. Hotels, restaurants, and retail outlets often welcome Visa, MasterCard, and American Express. This convenience makes cards a great option for larger purchases.

However, be aware of potential fees. Some businesses may charge extra for card transactions. To avoid surprises, ask about fees before paying. For smaller purchases, cash is still the way to go.

By balancing cash and card usage, you can manage your currency effectively. This approach ensures flexibility and security, no matter where your travel takes you.

How to Get Money in El Salvador: ATMs, Exchanges, and Transfers

Accessing funds while traveling can be simple with the right preparation. Whether you’re withdrawing from ATMs, exchanging currency, or using money transfers, knowing your options ensures you’re never left without accessible funds. Here’s a guide to help you navigate the process smoothly.

ATM Withdrawals and Safety Tips

ATMs are a convenient way to access cash during your trip. Major banks like Banco Agrícola and Banco Promerica offer reliable services. Always choose machines in secure locations, such as inside banks or shopping centers, to minimize risks.

Before using an ATM, check for any international withdrawal fees. Some banks, like Scotiabank, allow fee-free withdrawals for members of the Global ATM Alliance. It’s also wise to notify your bank of your travel plans to avoid blocked transactions.

Currency Exchange Bureaus and Banks

Currency exchange bureaus are widely available in tourist areas, shopping centers, and airports. While airport exchanges are convenient, they often have less favorable rates. For better deals, visit licensed bureaus in the city.

Reputable banks in the country include Banco Agrícola and Banco Promerica. They offer reliable exchange services with competitive rates. Always carry a photo ID, such as a passport, when exchanging currency.

By planning ahead and understanding your options, you can manage your finances effectively and focus on enjoying your travel experience.

Security Tips for Handling Cash and Card Transactions

Staying safe while managing your finances is crucial for a stress-free trip. Whether you’re exploring bustling cities or relaxing in serene landscapes, protecting your funds ensures a smooth experience. Here’s how to handle your money securely during your travel.

Safe Practices on Public Transportation

Public transportation is a convenient way to get around, but it requires extra caution. Avoid displaying large amounts of cash or valuable items. Keep your wallet in a zippered bag or an inside pocket to deter pickpockets.

When using buses or taxis, sit near the driver or in well-lit areas. If you’re carrying a bag, keep it on your lap rather than placing it on the floor. These small steps can significantly reduce the risk of theft.

Protecting Your Funds on the Go

Carry only the money you need for the day and leave the rest in a secure location, like a hotel safe. Use ATMs in well-lit, secure areas, preferably inside banks or shopping centers. Always check for skimming devices before inserting your card.

For added security, notify your bank of your travel plans to avoid blocked transactions. Consider using a travel money card for added protection against fraud. Here’s a quick guide to help you stay safe:

| Tip | Why It Matters |

|---|---|

| Use zippered bags | Prevents pickpocketing in crowded areas |

| Choose secure ATMs | Reduces the risk of card skimming |

| Carry minimal cash | Limits loss in case of theft |

By following these tips, you can enjoy your travel with confidence, knowing your currency and cards are safe. Stay vigilant and make the most of your journey in this beautiful country.

Exploring Local Payment Culture and Tipping Etiquette

Understanding local payment culture can enhance your travel experience and help you connect with the community. In this vibrant country, cash remains the backbone of daily transactions, especially in traditional markets and small businesses. Respecting local customs ensures a smooth and enjoyable journey.

Local Markets and Street Vendors

Local markets and street vendors are the heart of the community. Here, cash is king. Most vendors prefer physical money for quick and hassle-free transactions. Carrying smaller bills, like $1, $5, and $10, is ideal for these purchases.

Street food, handmade crafts, and fresh produce are often priced affordably. Having cash on hand ensures you can enjoy these unique experiences without missing out. It’s also a great way to support local businesses directly.

Customary Tipping Practices

Tipping is a common practice in restaurants, hotels, and with tour guides. A 10% tip is customary in restaurants, but always check if a service charge is already included. For hotel staff and tour guides, small tips are appreciated for their services.

Here’s a quick guide to tipping in this country:

| Service | Recommended Tip |

|---|---|

| Restaurants | 10% of the bill |

| Hotel Staff | $1-$2 per service |

| Tour Guides | $5-$10 per day |

Carrying extra cash specifically for tips ensures you’re prepared to show appreciation for excellent service. This small gesture goes a long way in building positive connections during your travel.

The Role of Travel Money Cards in El Salvador

Travel money cards are a game-changer for international trips. They offer a secure and convenient way to manage your money while exploring a new country. Unlike traditional bank cards, these cards are not linked to your primary account, adding an extra layer of security.

Benefits of Using a Travel Money Card

One of the biggest advantages is the ability to lock in favorable exchange rates before your travel. This means you won’t lose out on fluctuating currency values. Additionally, these cards often come with low or no foreign transaction fees, saving you money on every purchase.

Here are some key benefits of using a travel money card:

- Security: Not linked to your main bank account, reducing fraud risk.

- Convenience: Accepted worldwide for payments and ATM withdrawals.

- Cost-Effective: Competitive exchange rates and minimal fees.

Compared to carrying cash, travel money cards are safer and more practical. They’re ideal for daily transactions, from dining out to shopping. Whether you’re in urban areas or rural spots, these cards ensure you’re always prepared.

By using a travel money card, you can focus on enjoying your travel experience without worrying about financial hassles. It’s a smart way to stay in control of your funds while exploring this vibrant country.

Choosing the Best Travel Money Card for Your Trip

Selecting the right travel money card can save you time and money during your trip. With so many options available, it’s important to know what features to look for. A good card should offer low fees, competitive exchange rates, and strong security features.

Top Travel Card Features

When choosing a travel money card, focus on these key features:

- Low Fees: Look for cards with no foreign transaction fees or ATM withdrawal charges.

- Competitive Exchange Rates: Cards like Wise offer mid-market rates, ensuring you get the best value for your currency.

- Security: Features like instant transaction notifications and the ability to freeze your card add extra protection.

How to Compare Card Options

Comparing travel money cards is easy when you know what to look for. Start by checking the exchange rates and fees for each card. For example, Wise allows fee-free withdrawals up to a certain limit, while Chime offers no hidden fees.

Next, consider the card’s usability. Can you manage it through an app? Does it support multiple currencies? These factors can make a big difference during your travel.

Finally, read reviews and compare real-world experiences. Popular options like Monzo and Netspend are known for their user-friendly features and cost-saving benefits.

By taking the time to evaluate your options, you can find a travel money card that suits your needs. Whether you’re exploring a bustling city or a remote village, the right card ensures you’re always prepared.

Optimizing Fees and Exchange Rates When Traveling

Traveling abroad doesn’t have to mean overspending on hidden fees and poor exchange rates. With a few smart strategies, you can keep more of your money in your pocket and enjoy your travel experience to the fullest. Here’s how to minimize costs and maximize value.

Minimizing ATM and Card Fees

ATM fees can add up quickly, especially when withdrawing cash in a foreign country. To avoid these costs, compare your bank’s fees with those of local ATMs. Some banks, like Starling, offer fee-free withdrawals, making them a great choice for travelers.

Using apps like ATM Fee Saver can help you locate fee-free ATMs nearby. These tools save you time and money, ensuring you’re not caught off guard by unexpected charges. Always notify your bank of your travel plans to avoid blocked transactions.

Getting the Best Exchange Rates

Exchange rates can vary significantly depending on where you convert your currency. Avoid airport exchanges, as they often have the worst rates. Instead, use reputable exchange bureaus or multi-currency cards like Wise, which offer competitive rates and low fees.

Here are some tips to secure the best rates:

- Compare rates online before exchanging money.

- Use multi-currency cards to lock in favorable rates.

- Withdraw larger amounts to reduce the number of transactions and fees.

By following these strategies, you can make the most of your travel budget and avoid unnecessary expenses. Planning ahead ensures you’re prepared for any financial situation during your trip.

Planning Your Currency Exchange and Payment Methods in Advance

Planning your finances before your trip ensures a smooth and stress-free experience. Whether you’re exploring bustling cities or remote villages, understanding the local payment landscape is key to managing your money effectively. By researching and preparing in advance, you can avoid unnecessary hassles and focus on enjoying your travel.

Preparation for Rural vs Urban Transactions

In rural areas, cash is often the primary payment method. Local markets, small businesses, and public transportation typically rely on physical money. Carrying smaller bills ensures you’re ready for quick transactions or tipping. It’s also a good idea to keep extra cash as a backup, especially in regions with limited ATM access.

In contrast, urban areas offer more flexibility with card and digital payments. Hotels, restaurants, and retail outlets often accept Visa, MasterCard, and American Express. Setting up a travel money card before your trip ensures you’re prepared for these transactions. Look for cards with low fees and competitive exchange rates to maximize your budget.

Here’s a quick comparison to help you plan:

| Area | Preferred Payment Method | Tips |

|---|---|---|

| Rural | Cash | Carry small bills and extra cash |

| Urban | Cards/Digital Payments | Use a travel money card with low fees |

By understanding these differences, you can manage your currency effectively and stay prepared for any situation. Proactive planning ensures you’re never caught off guard, even in less developed regions of the country.

Tips for Budget-Friendly Travel in El Salvador

Traveling on a budget doesn’t mean missing out on amazing experiences. With careful planning, you can make the most of your money while exploring this vibrant destination. Here’s how to save on daily transactions and prepare for unexpected expenses.

Saving on Daily Transactions

Cutting down on fees is one of the easiest ways to stretch your budget. Use fee-free travel money cards to avoid extra charges on purchases and ATM withdrawals. These cards often offer competitive exchange rates, saving you currency conversion costs.

Track your daily spending to avoid overspending. Apps like Trail Wallet or Spendee can help you monitor expenses and stay within your budget. This simple habit ensures you’re always in control of your money.

Budgeting for Unexpected Expenses

Unexpected costs can arise during any trip. Set aside a small emergency fund to cover surprises like medical expenses or last-minute transportation. This safety net ensures you’re prepared without derailing your budget.

Consider travel insurance for added protection. It can cover unforeseen events like trip cancellations or lost luggage, giving you peace of mind during your travel.

Here’s a quick guide to managing your budget effectively:

| Tip | Benefit |

|---|---|

| Use fee-free cards | Saves on transaction and ATM fees |

| Track daily spending | Prevents overspending |

| Set aside emergency funds | Covers unexpected costs |

By following these tips, you can enjoy a budget-friendly trip without sacrificing convenience or security. Smart planning ensures you make the most of your travel experience.

Conclusion

With the right preparation, managing your finances while traveling becomes seamless and stress-free. This guide has covered essential tips for handling currencies, payment options, and staying safe. By planning your money management strategies in advance, you can avoid unnecessary hassles and focus on enjoying your trip.

Using a balanced mix of cash, cards, and travel money cards ensures flexibility and security. Follow practical safety tips to protect your funds and optimize fees to save more. Whether you’re exploring bustling cities or remote areas, these strategies will help you stay prepared.

With these insights, you’re ready to embark on your journey with confidence. Enjoy every moment, knowing your finances are well-managed and secure. Happy travels!

The above is subject to change.

Check back often to TRAVEL.COM for the latest travel tips and deals.

0 Comments