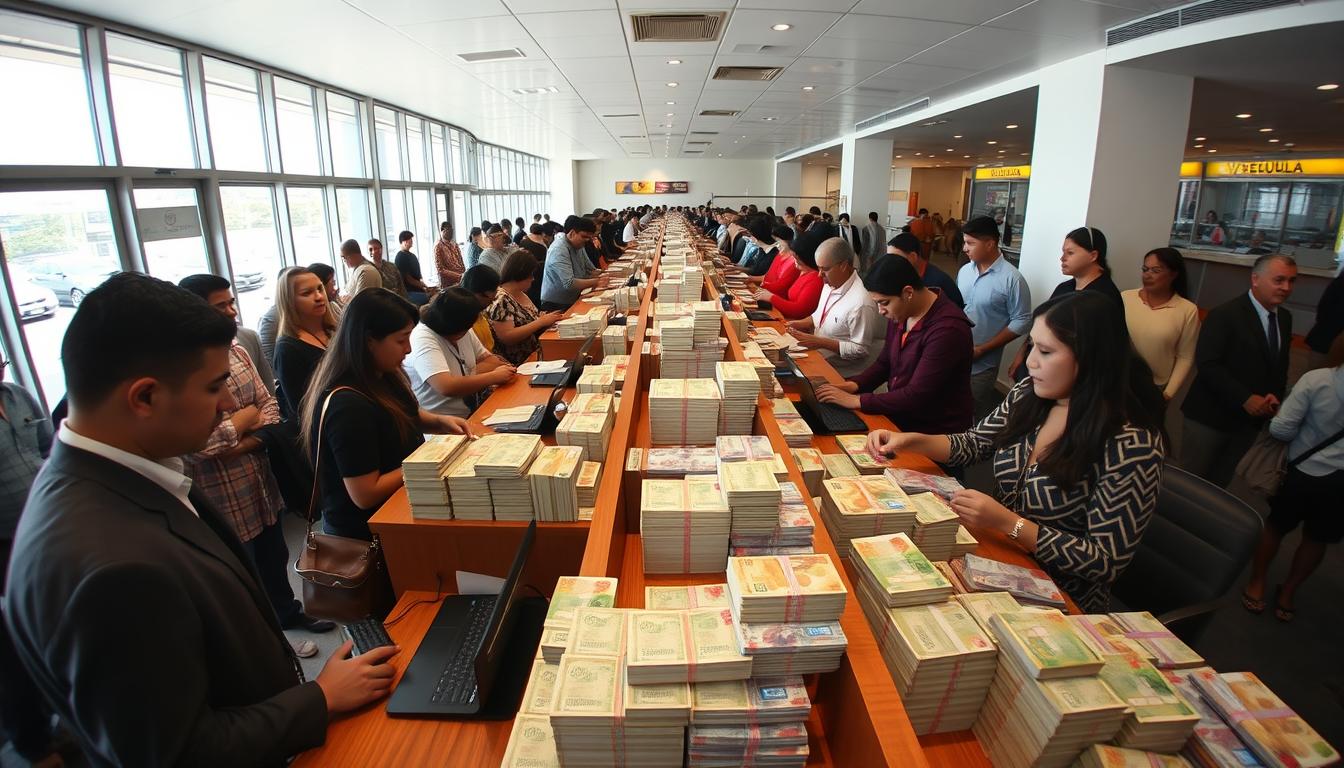

Did you know that Venezuela has one of the highest inflation rates in the world, reaching nearly 10,000% in 2019? This economic backdrop creates a unique challenge for visitors, especially when it comes to handling money. Understanding the local currency situation is crucial for a smooth trip.

In this section, we’ll explore why the bolivar is gradually disappearing and why US dollars have become the dominant currency. You’ll also learn about the importance of knowing both official and unofficial exchange rates. This knowledge can save you money and make your travel experience more enjoyable.

We’ll provide practical tips on how to navigate banks, ATMs, and local transactions. Whether you’re exchanging foreign currency or using a credit card, these insights will help you make the most of your trip. Stay tuned for valuable advice on handling money in this fascinating country.

Understanding Venezuela’s Economic Landscape

Economic instability has transformed how locals and visitors handle money. The country’s financial system is shaped by years of hyperinflation and currency devaluation. This has led to dramatic changes in everyday transactions and the cost of living.

Hyperinflation and Currency Devaluation

Hyperinflation has made it difficult for people to afford basic goods. For example, the price of staple items like bread can increase significantly within a single day. This instability affects everyone, from locals to tourists.

The local currency has repeatedly lost value despite government efforts to stabilize it. Reissuing new versions of the currency, like the bolivar soberano, has not solved the underlying issues. This has led to a reliance on foreign currencies, especially the US dollar.

The Role of the Bolivar Soberano

The bolivar soberano was introduced to combat hyperinflation, but its value continues to decline. Official exchange rates often differ greatly from real market values. This discrepancy can confuse both locals and visitors.

For travelers, understanding these dynamics is crucial for safe financial planning. Using US dollars simplifies transactions and avoids the complexities of the local currency system. It’s also important to carry cash, as not all places accept cards.

Here are some key points to keep in mind:

- Always check the current market rates before exchanging money.

- Carry small denominations of US dollars for everyday expenses.

- Be cautious when using ATMs or banks, as services may be limited.

These economic challenges shape daily life in the country. By staying informed, you can navigate the financial landscape more effectively during your travel.

Venezuela: Ultimate Travelers Guide to Currencies & Payments

Using US dollars simplifies transactions in places where the local currency is unreliable. For travelers, this is a game-changer. It avoids the hassle of dealing with fluctuating exchange rates and ensures smoother payments for services like hotels, taxis, and restaurants.

Hyperinflation has made the local currency unstable. Prices can change drastically within a single day, making it hard to budget. By using US dollars, you can avoid these uncertainties and focus on enjoying your trip.

Many businesses prefer US dollars because they hold their value better. This includes small shops, markets, and even some banks. Carrying cash in small denominations is especially helpful for everyday expenses.

The Impact of a Dollarized Economy

A dollarized economy has reshaped daily life for both locals and visitors. It offers stability in a country where the local currency often loses value. For travelers, this means fewer complications when paying for goods and services.

Credit cards like Mastercard and Visa are widely accepted, but relying on them can be risky. ATMs often run out of cash or charge high fees. Having US dollars on hand ensures you’re always prepared.

Here are some key benefits of using US dollars:

- Simplifies transactions in hotels, restaurants, and taxis.

- Reduces the risk of pricing discrepancies due to hyperinflation.

- Provides a reliable alternative to unreliable ATMs.

By planning ahead and carrying US dollars, you can navigate the financial landscape with confidence. This approach not only saves time but also enhances your overall travel experience.

Navigating Payment Methods in Venezuela

Handling money in a foreign country can be tricky, especially when dealing with unique economic conditions. Knowing your options ensures smooth transactions and helps you avoid unnecessary fees or complications.

Using Credit and Debit Cards Effectively

Credit and debit cards are widely accepted in urban areas, but not all types work equally. Mastercard is more commonly accepted than American Express. Always carry a backup card in case one is declined.

Be mindful of exchange rates and fees. Some banks charge high fees for international transactions. To save money, check your bank’s policies before your trip.

Mobile Payments and Modern Solutions

Mobile payment options are growing in popularity, especially in cities. These solutions offer convenience and often lower fees compared to traditional methods. Apps like PayPal and local platforms can simplify your transactions.

However, not all businesses accept mobile payments. It’s wise to carry some cash or a card as a backup. This ensures you’re prepared for any situation.

Here are some tips to make the most of your payment options:

- Carry multiple cards, including a Mastercard and a backup.

- Use mobile payments where available to save on fees.

- Always have some cash for small purchases or emergencies.

By planning ahead, you can navigate the financial landscape with confidence. This approach not only saves time but also enhances your overall travel experience.

Managing Currency Exchange and Avoiding Pitfalls

Navigating currency exchange in a foreign country can be tricky, especially when official and black market rates differ drastically. Understanding these differences and knowing how to exchange money safely can save you time and money during your travel.

Official Exchange vs. Black Market Rates

Official exchange rates often differ significantly from black market rates. For example, while the official rate might be 1 USD to 40 bolivars, the black market could offer 1 USD to 100 bolivars. This discrepancy can make a big difference in your budget.

Always research current market rates before exchanging money. Relying on official rates alone can leave you shortchanged. Be cautious of scams and verify the credibility of exchange sources.

Tips for Safe Money Exchanges

Exchanging money safely requires planning. Avoid exchanging large amounts at airports or terminals, as rates are often unfavorable. Instead, use trusted local exchange offices or banks.

Here are some practical tips:

- Carry small denominations of US dollars for everyday expenses.

- Verify exchange rates from multiple sources to ensure fairness.

- Use a card like Visa or Mastercard for larger transactions when possible.

Handling Cash: What Denominations to Carry

Carrying the right cash denominations is crucial. Small bills are more useful for daily transactions like taxis, meals, and tips. Large bills can be harder to break and may attract unwanted attention.

Keep some local currency for small purchases, but rely on US dollars for larger expenses. This approach ensures you’re prepared for any situation without carrying excessive cash.

By planning ahead and staying informed, you can navigate currency exchange with confidence and avoid common pitfalls.

Practical Travel Tips and Local Customs

Understanding local customs and safety measures can make your trip smoother and more enjoyable. Whether you’re dining out, exploring the city, or using public transportation, knowing what to expect helps you navigate with confidence.

Tipping Etiquette and Service Charges

Tipping is appreciated but not always expected. In restaurants, a service charge of 10% is often included in the bill. If not, leaving 5-10% is customary. For taxis, rounding up the fare is a polite gesture.

In hotels, tipping staff like bellhops or housekeepers is common. A small amount in local currency or US dollars is sufficient. Always carry small bills for tipping to avoid inconvenience.

Safety Precautions and Navigating Local Areas

Safety is a priority when traveling. Avoid displaying valuables like your card or cash in public. Stick to well-lit areas at night and be cautious in crowded places where pickpocketing can occur.

Public transportation is affordable but can be crowded. Use trusted taxi services or ride-sharing apps for convenience. Always confirm the fare before starting your journey to avoid surprises.

Here are some additional tips to stay safe:

- Keep a copy of your visa and passport in a secure place.

- Be aware of your surroundings, especially in unfamiliar areas.

- Use a money belt or hidden pouch for important documents and cash.

By following these tips, you can focus on enjoying your travel experience while staying safe and respectful of local customs.

Conclusion

Preparing for a trip involves more than just packing; understanding the financial landscape is key. Navigating economic challenges and payment methods can make your journey smoother and more enjoyable.

Using US dollars simplifies transactions and avoids the hassle of fluctuating exchange rates. Proper card management, like carrying a Mastercard or Visa, ensures you’re always prepared. Planning your money exchange carefully can save you time and avoid unnecessary fees.

Safety is equally important. Be mindful of your surroundings and keep important documents like your visa secure. Tipping for service is appreciated but not always expected, so carry small bills for convenience.

By staying informed and prepared, you can focus on enjoying your trip. Revisit this guide for updates and additional tips as travel conditions evolve. Preparation is the key to a stress-free and memorable experience.

The above is subject to change.

Check back often to TRAVEL.COM for the latest travel tips and deals.

0 Comments