Did you know that foreign transaction fees can add up to hundreds of dollars during international trips? Managing money abroad doesn’t have to be stressful or expensive. With the right tools, you can save time and avoid hidden costs.

Travel money cards, like the Wise Multi-Currency Card, let you top up in USD and convert to XOF at the mid-market exchange rate. This means no hidden fees and competitive rates. Plus, you get free ATM withdrawals and secure spending options.

Other popular cards, such as Chime, Monzo, and Netspend, also offer similar benefits. These tools help you avoid unnecessary charges and make your trip smoother. This guide will walk you through practical steps, tips, and security measures for handling cash and cards abroad.

Introduction: Understanding the Currency Landscape in Benin

Managing your finances in Benin starts with knowing the local currency. The West African CFA Franc (XOF) is the official currency used not only in Benin but also in several other countries in the region. This makes it a convenient option for travelers exploring multiple destinations.

Currency and Payment Methods Overview

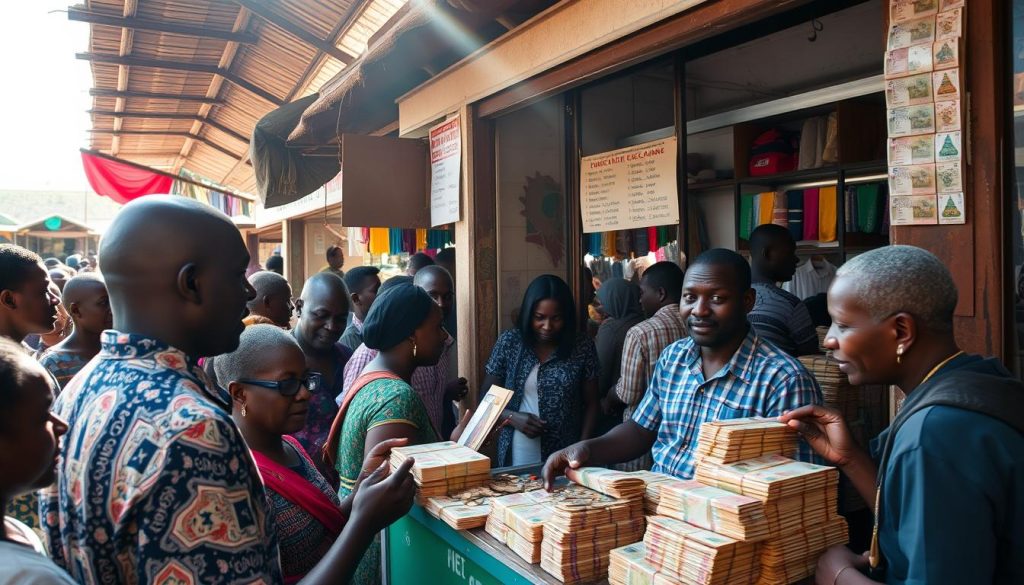

In Benin, cash remains essential for everyday transactions, especially in rural areas. However, card payments are becoming increasingly common in urban centers. ATMs are widely available, making it easy to withdraw cash when needed. Using an international travel card can help you avoid high fees at airport exchanges and streamline your spending.

Here are some key points to consider:

- Cash is still king in many places, so always carry some XOF for small purchases.

- Cards are accepted in hotels, restaurants, and larger stores, but check for foreign transaction fees.

- ATMs are reliable but may charge withdrawal fees, so plan accordingly.

Key Factors for International Travelers

When traveling to Benin, it’s important to balance cash and card usage. This approach helps you manage unexpected costs and avoid unnecessary fees. For example, using a travel money card with no foreign transaction fees can save you money on every purchase.

Here’s what to keep in mind:

- Look for ATMs in secure locations to minimize risks.

- Always notify your bank about your travel plans to avoid card blocks.

- Carry a mix of cash and cards to ensure you’re prepared for any situation.

By understanding the currency landscape and planning ahead, you can make your trip to Benin smoother and more cost-effective.

Choosing the Best Travel Money Card for Benin

Choosing the right travel money card can make or break your international experience. With so many options available, it’s essential to pick one that fits your needs. Whether you’re looking for low fees, secure transactions, or easy withdrawals, the right card can save you time and money.

Wise Multi-Currency Card Overview

The Wise Multi-Currency Card is a top choice for frequent travelers. It supports over 40 currencies, making it perfect for trips to multiple destinations. With low conversion fees and mid-market exchange rates, you’ll save on every transaction. Plus, it offers free ATM withdrawals up to a certain limit, ensuring you always have access to cash.

Users love its user-friendly app, which allows you to manage your money on the go. Ordering the card is simple, and it arrives quickly, so you’re ready for your next adventure.

Comparative Analysis: Chime, Monzo, and Netspend

If you’re exploring other options, Chime, Monzo, and Netspend are worth considering. Each card offers unique benefits tailored to different travel needs.

Chime is known for its no foreign transaction fees and seamless mobile app. Monzo provides real-time spending notifications and minimal ATM fees. Netspend, on the other hand, offers secure virtual card options for online purchases.

| Card | Key Features | User Rating |

|---|---|---|

| Wise | 40+ currencies, low fees, free withdrawals | 4.8/5 |

| Chime | No foreign transaction fees, mobile app | 4.6/5 |

| Monzo | Real-time notifications, minimal ATM fees | 4.5/5 |

| Netspend | Secure virtual cards, prepaid options | 4.3/5 |

Each of these cards ensures secure and convenient transactions during your trip. By comparing their features, you can find the one that best suits your travel style.

Advantages and Disadvantages of Travel Money Cards

Travel money cards have become a game-changer for international trips. They offer convenience, security, and cost savings, but they also come with potential drawbacks. Understanding both sides can help you decide if they’re the right choice for your travels.

Pros of Using a Travel Money Card

One of the most significant advantages is the competitive exchange rate. Many cards, like the Wise Multi-Currency Card, use the mid-market rate, saving you money on every transaction. You can also manage multiple currencies on a single card, making it ideal for trips to different countries.

Security is another key benefit. Travel cards are not linked to your primary bank account, reducing the risk of fraud. Features like instant transaction notifications and 2-factor authentication add an extra layer of protection.

Lastly, these cards simplify payment processes. With contactless options and widespread acceptance, you can spend confidently in most locations.

Cons and Potential Drawbacks

While travel money cards offer many benefits, they’re not without limitations. Some cards charge monthly fees or have hidden costs, like ATM withdrawal fees. Be sure to read the fine print before choosing a card.

Another drawback is the limited withdrawal amounts. For example, Chime has a daily limit of $500, which might not be enough for some travelers. Additionally, not all cards offer the same level of service, so research is essential.

Finally, while these cards are secure, losing one can still be inconvenient. Always have a backup plan, like carrying a small amount of cash or a secondary card.

By weighing the pros and cons, you can select a travel money card that aligns with your needs. Whether you prioritize low fees, security, or convenience, there’s a card out there for you.

Managing Currency Exchange and Transaction Fees

Hidden fees can quickly add up if you’re not careful with currency exchanges. Understanding how these fees work is a good idea to keep your travel budget intact. From exchange rates to ATM charges, every detail matters when managing your money abroad.

Understanding Exchange Rates and Hidden Costs

Exchange rates determine how much your money is worth in another currency. The mid-market rate is the benchmark used by banks and financial institutions. However, most providers add a markup, which increases your costs. Knowing this can help you find the best option for currency conversion.

Hidden fees are another concern. Foreign transaction fees typically range from 1% to 3%, while currency conversion fees are around 1%. These charges can add up, especially if you’re making frequent purchases or withdrawals. Using a travel money card with low fees is one way to avoid these extra costs.

Here’s a quick comparison of fees:

- Banks: Often charge higher fees for international transactions and ATM withdrawals.

- Travel Money Cards: Offer competitive exchange rates and lower fees, making them a better option for frequent travelers.

Planning your currency exchanges in advance can save you both time and money. For example, exchanging cash at airports is usually more expensive than using ATMs or travel cards. Always check the rates and fees before making a decision.

By carefully managing these costs, you can make the most of your travel budget. Whether you choose a bank or a travel card, being informed is the best way to avoid unnecessary expenses.

Benin: Ultimate Travelers Guide to Currencies & Payments

A well-prepared traveler is always one step ahead of potential challenges. Organizing your finances in advance ensures a stress-free and enjoyable trip. Here’s how you can streamline your money management and stay secure during your travels.

Pre-Trip Preparations

Start by securing a reliable travel money card. Cards like the Wise Multi-Currency Card allow you to manage multiple currencies and avoid high conversion fees. Plan your currency exchanges in advance to get the best rates and minimize unnecessary costs.

Here’s a quick checklist to follow:

- Order your travel card at least two weeks before departure.

- Notify your bank about your travel dates to avoid card blocks.

- Carry a mix of cash and cards for flexibility.

Security Best Practices

Safety is paramount when managing your money abroad. Set up transaction alerts on your card to monitor spending in real-time. If your card is lost or stolen, freeze it immediately through the provider’s app. This prevents unauthorized use and protects your funds.

Additional tips include:

- Avoid using ATMs in isolated or poorly lit areas.

- Keep a backup card and emergency cash in a separate location.

- Use secure Wi-Fi networks for online transactions.

Real-Life Examples

Many travelers rely on the Wise Multi-Currency Card for its low fees and secure features. For instance, one user shared how they saved over $50 in conversion fees during a two-week tour. Such tools not only reduce costs but also provide peace of mind.

| Step | Benefit |

|---|---|

| Order a travel card in advance | Access competitive exchange rates |

| Set transaction alerts | Monitor spending and detect fraud |

| Carry a backup card | Ensure access to funds in emergencies |

By planning ahead and following these tips, you can enjoy a smooth and secure tour. Whether you’re exploring bustling cities or remote areas, these steps will help you stay prepared and confident throughout your journey.

Tips for Safe and Cost-Effective ATM Withdrawals

Navigating ATM withdrawals abroad doesn’t have to be a hassle if you know the right strategies. By planning ahead and staying informed, you can avoid extra fees and keep your money safe. Here’s how to make the most of your ATM use during your travels.

Finding Reliable ATM Networks

Choosing the right ATM is crucial for both safety and cost-effectiveness. Stick to machines located inside banks, hotels, or near reputable restaurants. These locations are often monitored and less likely to be tampered with.

Here’s a quick checklist for identifying reliable ATMs:

- Look for ATMs with visible security cameras.

- Avoid standalone machines in poorly lit or isolated areas.

- Check for customer reviews or recommendations online.

Strategies to Avoid Extra Fees

Extra fees can add up quickly if you’re not careful. One idea is to withdraw larger amounts less frequently to minimize transaction costs. Always check your bank’s fee structure before traveling to avoid surprises.

Here are some additional tips:

- Use ATMs affiliated with your bank to reduce withdrawal fees.

- Decline currency conversion offers at the ATM to avoid unfavorable rates.

- Plan your withdrawals during business hours to ensure access to assistance if needed.

For emergency situations, carry a mix of cash and a backup card. Digital banking apps can also help you monitor your spending and locate nearby ATMs. By following these strategies, you can save money and stay prepared for any situation.

Planning Your Budget and Payment Strategy

Creating a travel budget is the first step to a stress-free trip. By planning your daily expenses, you can avoid overspending and focus on enjoying your journey. Start by estimating how much you’ll need each day for meals, transportation, and activities.

Setting a Realistic Travel Budget

To set a realistic budget, consider your travel style and destination. For example, urban areas might require more spending on transportation, while rural areas could have limited card acceptance. Break down your expenses into categories like accommodation, food, and entertainment to get a clear picture.

Here’s how to track your spending effectively:

- Use a budgeting app to monitor expenses in real-time.

- Adjust your budget as circumstances change, such as unexpected costs or price fluctuations.

- Keep a small notebook or digital tracker for cash transactions.

Balancing cash and card use is also crucial. While cards are convenient, cash is often necessary for small purchases or in areas with limited card acceptance. Withdraw larger amounts less frequently to minimize ATM fees.

Exchange rates can fluctuate, so plan ahead to avoid surprises. Use a travel money card with competitive rates to save on conversions. In case of sudden rate changes, having a flexible budget ensures you’re prepared.

Proper budgeting matters for a smooth trip. It helps you stay within your limits and enjoy your travels without financial stress. By planning your daily expenses and tracking your spending, you’ll have peace of mind throughout your journey.

Exploring Additional Payment Options and Local Banking Services

Exploring alternative payment methods can enhance your financial flexibility while traveling. Beyond traditional travel money cards, local banking services and mobile wallets offer unique advantages for managing your funds. These options ensure you’re prepared for any situation and provide an extra layer of safety.

Utilizing Local Bank Services and Mobile Wallets

Local bank services and mobile wallets are becoming increasingly popular for travelers. They allow you to manage your money efficiently and avoid high transaction fees. For example, mobile wallets like MTN Mobile Money and Orange Money are widely used in many regions, offering low-cost transfers and easy access to your funds.

Here’s how these options can benefit you:

- Safety: Mobile wallets are secure and often require biometric authentication, reducing the risk of fraud.

- Interest-free: Many local bank services and mobile wallets do not charge interest on transactions, saving you money.

- Convenience: These tools are accessible 24/7, making it easy to handle payments or transfers in any situation.

Advantages of Maintaining a Local Fund

Keeping a small amount of local currency on hand is a smart strategy. It ensures you’re prepared for unexpected expenses, especially in areas with limited card acceptance. This approach also helps you avoid unfavorable exchange rates at the last minute.

Here’s a quick comparison of payment options:

| Option | Key Features |

|---|---|

| Mobile Wallets | Low fees, instant transfers, biometric security |

| Local Bank Services | Interest-free transactions, reliable customer support |

| Travel Money Cards | Multi-currency support, competitive exchange rates |

By diversifying your payment methods, you can enjoy a smoother and more secure travel experience. Whether you choose mobile wallets, local bank services, or a combination of both, these tools provide the flexibility and safety you need for any situation.

Conclusion

Handling money efficiently during your trip starts with the right tools and knowledge. Understanding foreign transaction fees and choosing the best cash card can save you significant costs. Balancing cash and card payments ensures you’re prepared for any situation, whether it’s a taxi ride or a local market purchase.

Planning your ATM withdrawals in advance helps avoid unnecessary fees. Stick to secure locations and withdraw larger amounts less frequently. This strategy keeps your expenses low and your funds accessible.

By proactively managing your finances, you can focus on enjoying your adventure. The right preparation and tools make all the difference, ensuring a smooth and cost-effective journey.

The above is subject to change.

Check back often to TRAVEL.COM for the latest travel tips and deals.

0 Comments